Discover how Swift Close simplifies financial Tasks, freeing up more time for analysis and less time spent gathering data.

During our analysis, we found that accountants in organizations often face significant challenges with manual account reconciliation and reporting. The primary issues include labor-intensive processes, a high risk of errors due to manual work, and delays in report generation.

To tackle these challenges, we aim to automate and streamline repetitive tasks, enhance accuracy, and accelerate the closing process.

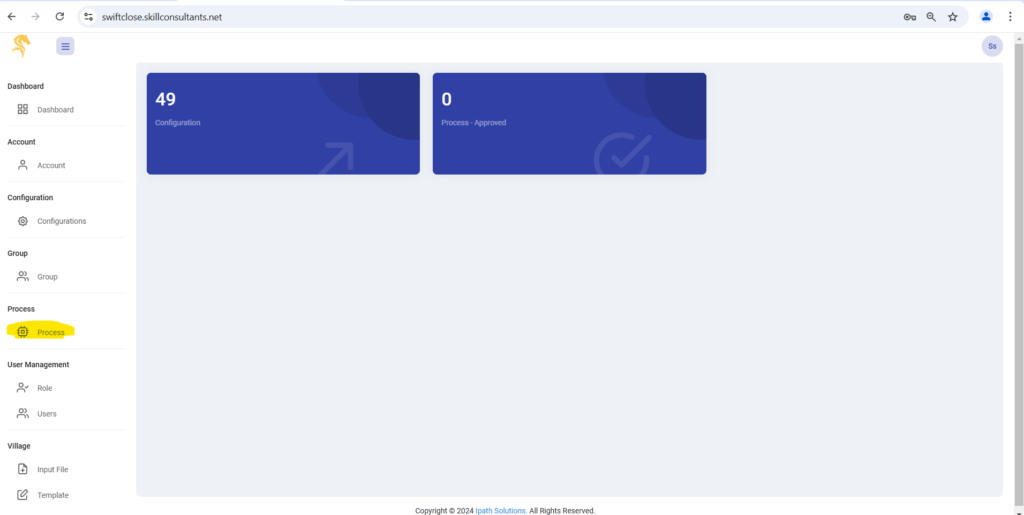

Swift Close is an AI-powered platform designed to revolutionize the month-end closing process for businesses by automating essential accounting functions. By harnessing the capabilities of artificial intelligence (AI) and machine learning, Swift Close streamlines tasks like account reconciliation, journal entries, accruals, and financial adjustments, dramatically enhancing both the speed and accuracy of financial closures.

Traditionally, month-end closing is a labor-intensive process, requiring businesses to manually reconcile accounts, record accruals, and generate financial reports—tasks that can span several days and are prone to human error. Swift Close eliminates these bottlenecks by automating these critical processes, enabling companies to close their books in a matter of hours, not days, while minimizing the risk of delays and mistakes.

Our Solutions :

Our solutions relieve your team of repetitive tasks, enabling them to concentrate on strategic analysis.

Our Mission :

To provide finance teams with additional time for analysis, enabling executives to make well-informed strategic decisions that lead to improved outcomes.

.

.

Reconciliation delay are one of the most common and disruptive challenges during the month-end close process.

For many businesses, manually reconciling accounts—matching transactions across ledgers, bank statements, and other financial records—can create significant delays.

These bottlenecks often prevent finance teams from closing the books on time, disrupting operational flow, and hindering timely financial reporting.

Swift Close eliminates this issue by automating the reconciliation process with AI-driven technology.

By cross-referencing financial data from multiple systems in real time, Swift Close quickly identifies discrepancies and flags them for review, dramatically reducing the time spent on manual matching.

The result is a faster, more accurate reconciliation process that seamlessly integrates with other aspects of month-end close.

In fact, Swift Close has already helped automate reconciliation for 30 communities, saving 6 hours per community each month, which adds up to more than 2,000 hours annually.

This automation not only speeds up the reconciliation process but also enhances accuracy by minimizing human error.

With discrepancies caught in real time, the risk of overlooking critical errors or missing transactions is greatly reduced, allowing for a smoother and more reliable financial close.

The time saved through automation can then be redirected to more strategic tasks, empowering finance teams to focus on higher-value activities like forecasting and decision-making.

By solving the problem of reconciliation delay, Swift Close significantly improves operational flow, allowing businesses to close their books faster and make data-driven decisions with up-to-date, accurate financial information.

This enhanced efficiency reduces stress during month-end close and ensures that financial reporting is completed on time, without the delays or errors that traditionally impede business operations.

Ultimately, Swift Close’s automation helps businesses stay agile, responsive, and competitive in a fast-paced market.

Swift Close automates month-end accounting processes by leveraging AI to handle time-consuming tasks such as account reconciliations, closing entries, and preparing financial reports. This reduces human error, ensures consistency, and speeds up the month-end close process, allowing businesses to focus on more strategic activities.

While Swift Close doesn’t directly manage cash flow, it helps improve cash flow management by automating month-end accounting tasks, such as invoicing and account reconciliation, which ensures that financial data is accurate and up-to-date. This, in turn, provides businesses with a clearer picture of their financial status, supporting better cash flow decisions.

Swift Close is ideal for mid-sized to larger businesses in the United States looking to optimize their month-end accounting processes. Companies in industries such as manufacturing, retail, and professional services, among others, can benefit from faster, more accurate month-end closes, leading to better financial oversight.

Swift Close specializes in automating month-end accounting tasks such as account reconciliations, closing entries, generating financial reports, and preparing trial balances. This reduces the manual effort required for monthly financial close and ensures consistency and accuracy.

Swift Close streamlines the month-end accounting process by automating repetitive tasks like account reconciliation and financial reporting. This speeds up the close process, reduces manual errors, and helps financial teams close the books more quickly and accurately each month.

Swift Close automates the generation of financial reports, integrating data from various systems and accounting tools. This reduces the time spent on manual report preparation, ensuring accuracy and consistency in the reports generated during the month-end close process.