At S.K.I.L.L Consultants, we have developed a Platform called Swift Close that helps businesses speed up and improve their month-end closing process.

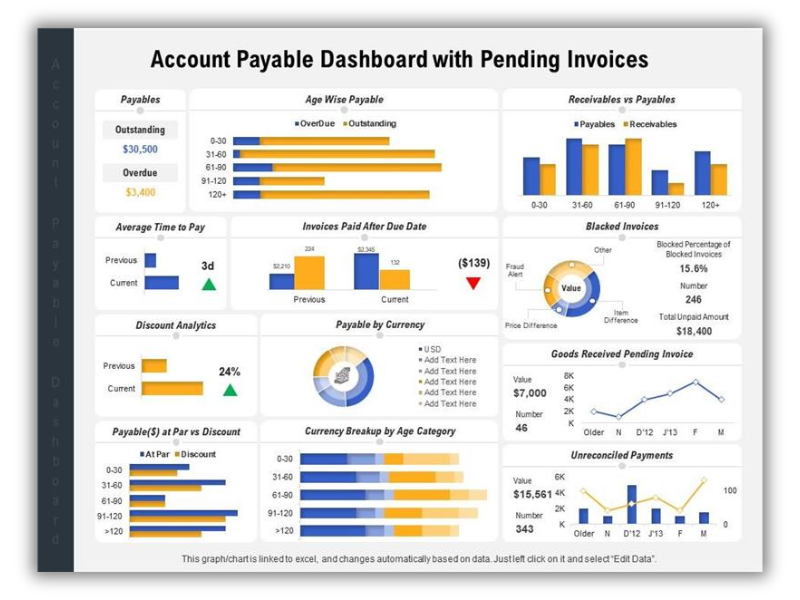

The month-end close is an important task where companies finalize their financial records for the month, including reconciling accounts, making adjustments, and generating financial reports.

This process can be time-consuming and error-prone, often taking days to complete. Swift Close, powered by S.K.I.L.L. Consultants, automates many of these tasks, reducing the time it takes to close the books and improving accuracy.

With Swift Close, account reconciliation, accruals, and adjustments are handled automatically, ensuring everything is recorded correctly and without delays. This means businesses can close their books much faster, often in just a few hours instead of several days, and with fewer mistakes. By reducing human error and automating repetitive tasks, Swift Close helps companies maintain more accurate financial records and get timely financial insights. It also makes the audit process smoother, as the system automatically tracks and reports all data in real time. Overall, Swift Close helps businesses improve their month-end close process, making it quicker, more accurate, and audit-ready.