In senior living and independent living organizations, cost structures are deeply intertwined with resident experience, care quality, regulatory compliance, and long-term sustainability. Financial decision-making cannot be isolated from operations—it must be embedded into how communities function every day.

Our financial professionals work as strategic partners to senior living operators, helping leadership teams move beyond reactive cost control toward intentionally designed, strategy-aligned cost structures that support growth, stability, and mission delivery.

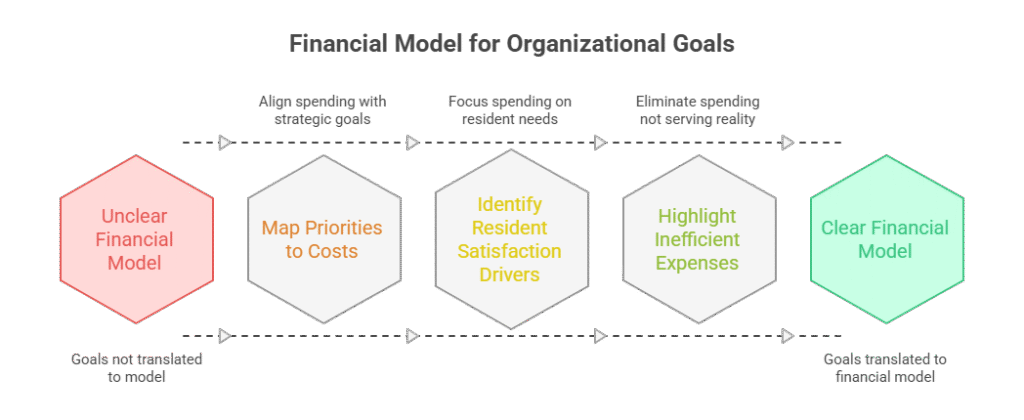

Translating Organisational Goals into a Practical Financial Model

Senior living organizations often have strong missions and growth ambitions, but those objectives are not always reflected in how costs are structured. Over time, legacy processes, staffing models, and administrative overhead can drift away from current priorities.

How we help:

Our team works closely with senior leadership to translate organizational goals—such as improving occupancy stability, enhancing resident experience, expanding independent living services, or strengthening compliance—into a clear financial operating model.

Our team works closely with senior leadership to translate organizational goals—such as improving occupancy stability, enhancing resident experience, expanding independent living services, or strengthening compliance—into a clear financial operating model.

We align costs with outcomes by:

- Mapping strategic priorities to specific cost drivers

- Identifying areas where spending directly supports resident satisfaction and retention

- Highlighting expenses that no longer serve today’s operating reality

This ensures that financial resources are deployed with intent, not habit.

Redesigning Cost Structures for the Senior Living Operating Environment

Traditional cost classifications do not fully capture the complexity of senior living operations. Labor, technology, dining, wellness, and compliance costs behave differently depending on acuity levels, occupancy trends, and regulatory requirements.

How we help:

Our financial professionals conduct deep cost structure assessments that go beyond line-item reviews. We analyze how costs behave across communities, departments, and service levels, then help leadership teams reframe expenses into meaningful categories such as:

Our financial professionals conduct deep cost structure assessments that go beyond line-item reviews. We analyze how costs behave across communities, departments, and service levels, then help leadership teams reframe expenses into meaningful categories such as:

- Costs that directly enhance care quality and resident experience

- Costs that scale with occupancy or can be optimized through process redesign

- Costs that exist due to outdated workflows or legacy decisions

This clarity enables smarter trade-offs—protecting mission-critical investments while addressing inefficiencies.

Optimizing Labor-Related Costs Without Compromising Care

Labor is the single largest expense for senior living organizations, and it is also the most sensitive. Staffing decisions directly impact resident safety, satisfaction, and regulatory outcomes.

How we help:

Rather than focusing on labor reduction, S.K.I.L.L. Consultants professionals help organizations optimize labor deployment by:

Rather than focusing on labor reduction, S.K.I.L.L. Consultants professionals help organizations optimize labor deployment by:

- Reducing administrative and manual work that pulls staff away from resident care

- Improving visibility into staffing costs by role, function, and community

- Supporting more accurate forecasting of staffing needs based on occupancy and acuity

By streamlining back-office finance and reporting processes, we help organizations redirect time and talent toward resident-facing activities—strengthening care delivery while stabilizing costs.

Embedding Financial Accountability Across Communities

In multi-community senior living organizations, financial accountability often breaks down due to fragmented reporting and limited real-time visibility. Leaders may know what they are spending, but not why variances occur or how decisions affect long-term performance.

How S.K.I.L.L. Consultants Expertise help:

Our team designs practical financial governance and reporting frameworks that provide:

Our team designs practical financial governance and reporting frameworks that provide:

- Community-level visibility into costs and performance

- Clear ownership of spending decisions

- Actionable insights rather than static budget reports

By aligning financial data with operational realities, we enable leaders to make informed decisions without burdening communities with excessive administrative work.

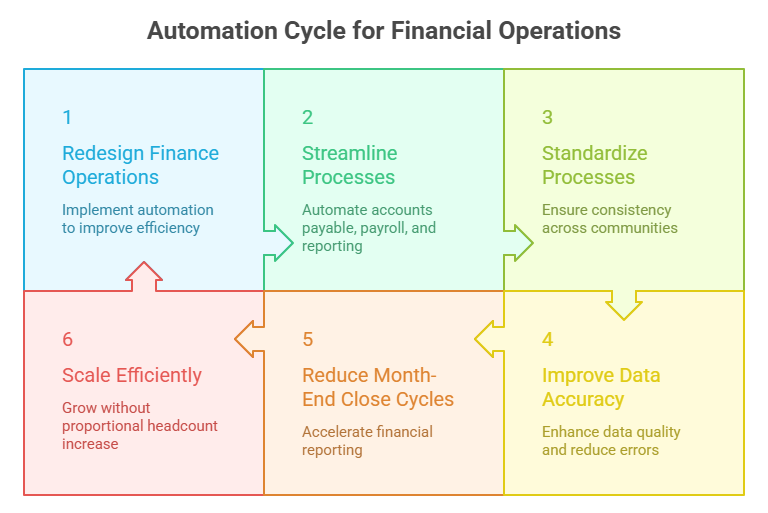

Using Automation to Simplify and Strengthen Financial Operations

Many senior living organizations still rely on manual, fragmented finance processes that increase cost, slow decision-making, and elevate compliance risk. Automation is often underutilized or applied only at the surface level.

How we help:

Our financial professionals specialize in redesigning finance operations through automation, not just digitizing existing inefficiencies. We help organizations:

Our financial professionals specialize in redesigning finance operations through automation, not just digitizing existing inefficiencies. We help organizations:

- Streamline accounts payable, payroll reconciliation, and reporting

- Standardize processes across communities

- Improve data accuracy and reduce month-end close cycles

This creates a cost structure that scales efficiently as organizations grow—without requiring proportional increases in administrative headcount.

Aligning Capital and Operating Decisions for Long-Term Sustainability

Capital investments in senior living—facilities, renovations, and technology—have long-lasting effects on operating costs. Misaligned decisions can lock organizations into high-cost structures that limit flexibility.

How we help:

Our professionals support leadership teams with forward-looking financial analysis and scenario modeling, helping them understand:

Our professionals support leadership teams with forward-looking financial analysis and scenario modeling, helping them understand:

- The long-term operating impact of capital decisions

- Trade-offs between upfront investment and recurring costs

- How capital choices support target resident profiles and occupancy goals

This ensures that both capital and operating costs reinforce the organization’s strategic direction.

Proactively Managing Compliance and Financial Risk

Compliance and regulatory requirements are a constant reality in senior living. Reactive approaches often lead to higher long-term costs, operational disruption, and reputational risk.

How we help:

We help organizations implement strong financial controls and standardized reporting frameworks that:

We help organizations implement strong financial controls and standardized reporting frameworks that:

- Reduce manual errors and audit risk

- Improve documentation and consistency

- Support proactive compliance management

By strengthening financial foundations, we help senior living organizations lower risk while reducing the hidden costs of inefficiency.

Connecting Cost Decisions to Occupancy and Resident Experience

In senior living, cost decisions are never purely financial. Choices related to staffing, dining, wellness, and services directly influence resident satisfaction, retention, and referrals.

How we help:

Our professionals help organizations connect financial data with operational and occupancy insights, allowing leadership teams to:

Our professionals help organizations connect financial data with operational and occupancy insights, allowing leadership teams to:

- Understand which costs drive resident experience

- Identify efficiencies that are invisible to residents

- Avoid cost reductions that could negatively impact satisfaction or reputation

This integrated approach ensures financial discipline supports—not undermines—market competitiveness.

Supporting Long-Term Value, Not Short-Term Fixes

Short-term cost reductions may provide temporary relief, but they often create deeper challenges in staff morale, service quality, and resident trust.

How we help:

S.K.I.L.L. Consultants act as a long-term financial partner, supporting ongoing reviews of cost relevance, operational efficiency, and strategic alignment. Our focus is on building resilient, adaptable cost structures that evolve with the organization’s needs.

S.K.I.L.L. Consultants act as a long-term financial partner, supporting ongoing reviews of cost relevance, operational efficiency, and strategic alignment. Our focus is on building resilient, adaptable cost structures that evolve with the organization’s needs.

Senior living and independent living organizations operate at the intersection of finance, care, and community. Aligning cost structure with strategy requires more than spreadsheets—it requires financial professionals who understand the operational, regulatory, and human realities of the industry.

Our team helps senior living organizations design cost structures that support care quality, financial sustainability, and long-term growth—turning financial complexity into clarity and confidence for the years ahead.