What Is Cash Flow Stabilization—and Why Is It Critical for Senior Healthcare Organizations?

- What cash flow stabilization really is

- Why senior healthcare organizations are uniquely vulnerable to cash flow disruption

- The real risks of unstable liquidity

- And how experienced financial professionals work with your internal team to stabilize cash—without disrupting care or culture

Understanding Cash Flow Stabilization: Beyond Basic Cash Management

It is not just a spreadsheet.

And it is not about reacting after cash is already depleted.

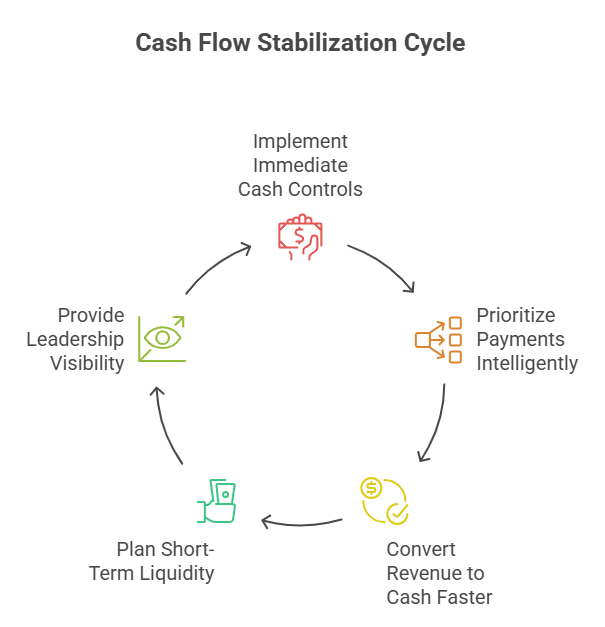

- Immediate cash controls

- Intelligent prioritization of payments

- Faster and cleaner conversion of revenue into cash

- Short-term liquidity planning

- Ongoing visibility for leadership decision-making

Why Senior Healthcare Organisations Face Unique Cash Flow Challenges

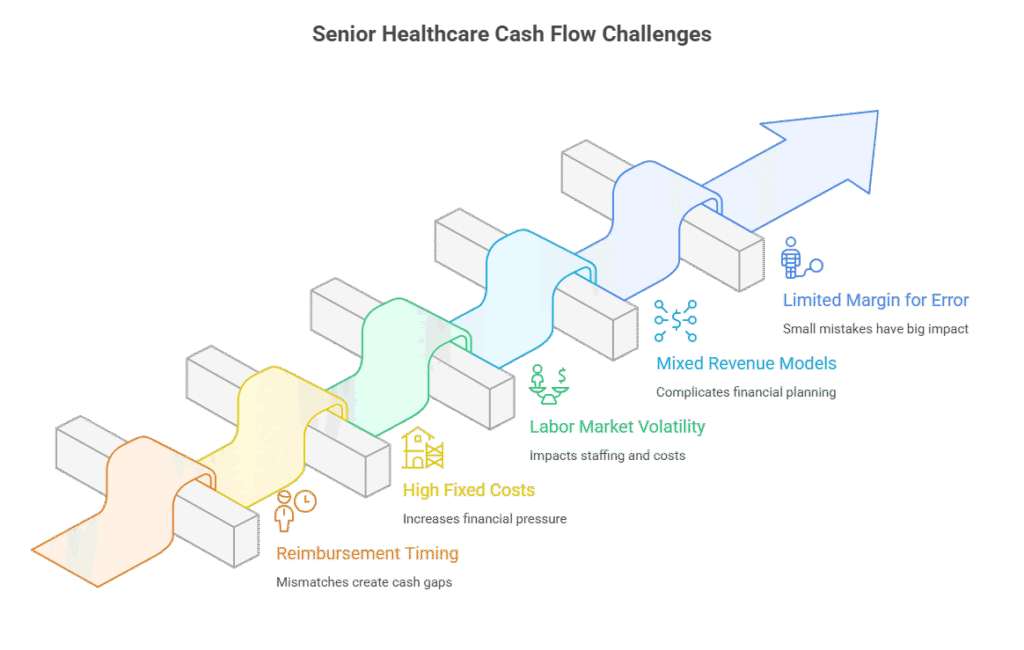

1. Reimbursement Timing Mismatches

- Documentation gaps

- Coding errors

- Authorization issues

- Denials and resubmissions

At the core of this challenge is the timing mismatch between when care is delivered and when cash is received. Medicare and Medicaid reimbursements, which form a significant portion of revenue for many organizations, are governed by complex billing rules, documentation requirements, authorizations, and audits. Even minor errors or missing information can delay payments for weeks or months. Private-pay arrangements, long-term care insurance, and grant-based funding introduce additional layers of variability. As a result, organizations may appear financially healthy on paper while experiencing daily cash pressure behind the scenes. Revenue may be earned, but liquidity remains uncertain.

2. High Fixed Costs

Payroll, benefits, food services, utilities, and medical supplies are non-negotiable expenses. Unlike discretionary industries, senior healthcare cannot scale costs down quickly when cash tightens.

3. Labor Market Volatility

Staffing shortages, overtime, agency staffing, and wage pressure increase cash outflows—often unpredictably.

Compounding this issue is the cost structure of senior healthcare. Labor is both the largest expense and the least flexible. Staffing levels are regulated, skill mixes are mandated, and workforce shortages often force providers to rely on overtime or agency staffing—driving costs higher precisely when cash is most constrained. At the same time, many expenses are fixed or semi-fixed: leases, utilities, insurance, food services, clinical supplies, and compliance-related costs cannot be deferred without risk. This leaves leadership with limited short-term levers when cash inflows slow.

4. Mixed Revenue Models

Many organizations manage a combination of:

Medicare

Medicaid

Private pay

Long-term care insurance

Grants and donations (for NGOs)

Each has different billing rules, timing, and risk profiles, making cash forecasting complex.

5. Limited Margin for Error

Small operational issues—missed billing steps, untracked denials, delayed grant reporting—can quietly compound into significant liquidity problems.

Senior healthcare organizations also manage a level of operational and regulatory complexity that intensifies cash flow risk. Billing, clinical documentation, finance, and compliance must work in close alignment, yet these functions often operate in silos. Small process breakdowns—such as delayed documentation, authorization lapses, or weak denial follow-up—can quietly accumulate into significant cash shortfalls. For nonprofit and mission-driven organizations, grant restrictions and reporting timelines further complicate cash planning, even when funding is secured.

Taken together, these factors create an environment where cash flow challenges are not the result of poor management, but a byproduct of the system itself. Understanding this reality is the first step toward building stronger cash controls, better visibility, and financial resilience. For senior healthcare organizations, addressing cash flow is not simply a finance function—it is a leadership imperative tied directly to care continuity, organizational stability, and long-term sustainability.

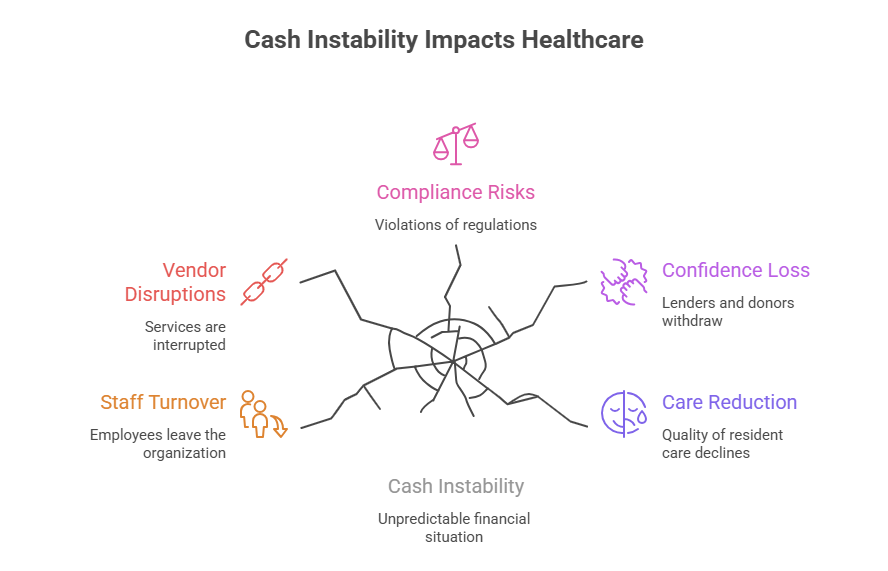

The Real Risk of Unstable Cash Flow

- Paying vendors late “just this once”

- Increasing reliance on short-term borrowing

- Growing AR aging without clear accountability

- Leadership spending more time managing cash than strategy

- Board conversations shifting from growth to survival

- Staff turnover and morale decline

- Vendor service disruptions

- Regulatory compliance risks

- Loss of lender or donor confidence

- Reduced quality of resident care

What Cash Flow Stabilization Actually Involves

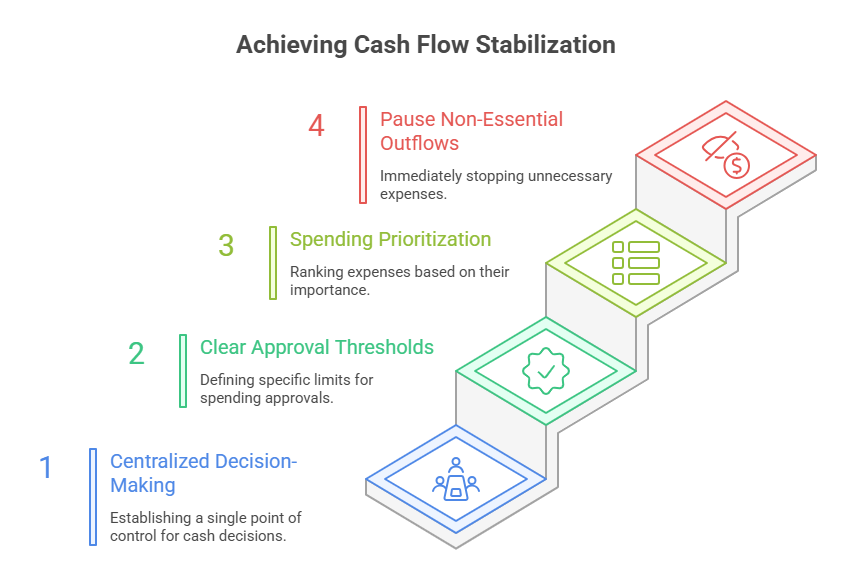

1. Emergency Cash Control Framework

Stabilization begins with control.

An emergency cash control framework establishes:

Centralized cash decision-making

Clear approval thresholds

Spending prioritization rules

Immediate pause on non-essential outflows

This is not about cutting blindly—it is about protecting mission-critical expenses while stopping unnecessary cash leakage.

For senior healthcare organizations, this ensures:

Payroll is protected

Resident care expenses are prioritized

Compliance-related costs are maintained

2. Accounts Payable Triage and Payment Prioritization

Not all bills carry equal risk.

AP triage categorizes obligations into:

Critical: payroll, food, utilities, medical supplies

Strategic: vendors essential to continuity of care

Deferrable: expenses that can be delayed or renegotiated

This structured approach replaces reactive payment decisions with intentional liquidity preservation.

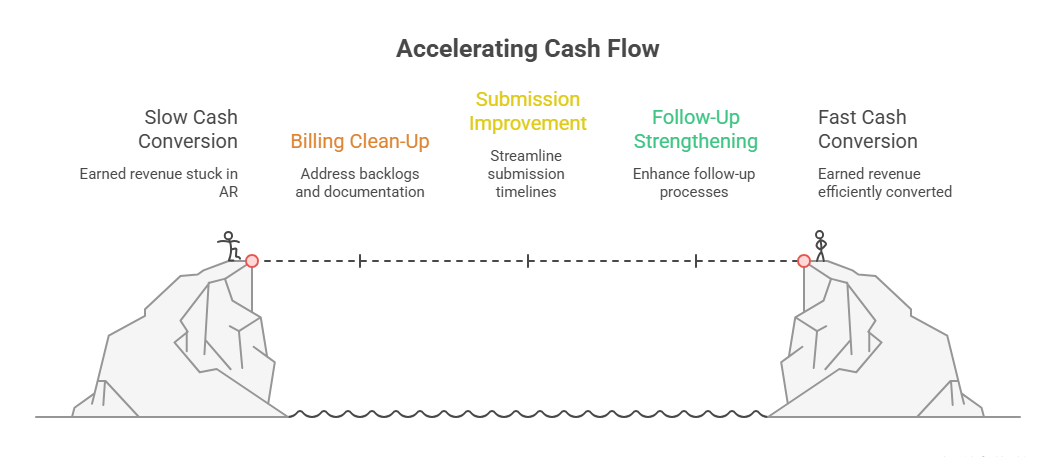

3. Accounts Receivable Acceleration and Billing Clean-Up

Cash flow improves fastest when earned revenue is converted into cash efficiently.

AR acceleration focuses on:

Cleaning billing backlogs

Fixing documentation gaps

Improving submission timelines

Strengthening follow-up processes

Resolving payer-specific issues

For NGOs, this includes:

Grant drawdown optimization

Alignment of reporting with reimbursement schedules

This work strengthens systems—not just short-term collections.

4. Revenue Cycle Turnaround

Revenue cycle issues are one of the most common—and costly—cash flow drains in senior healthcare.

Turnaround efforts address:

Medicare and Medicaid denials

Authorization failures

Coding inaccuracies

Delayed private-pay invoicing

Poor handoffs between clinical and billing teams

The objective is to eliminate friction points that delay cash, while maintaining compliance and audit readiness.

5. Short-Term Cash Infusion Strategy

Sometimes stabilization requires temporary liquidity support.

This may include:

Bridge funding

Receivable advances

Short-term credit solutions

Grant advances (for nonprofits)

The key is structure and timing. Poorly designed funding creates future distress. Properly aligned funding supports operations until cash systems stabilize

6. Daily and Weekly Cash Visibility Dashboards

Leadership cannot manage what it cannot see.

Cash dashboards typically provide:

Daily cash balances

Upcoming payroll and critical payments

7–13 week cash forecasts

Expected collections

Liquidity runway

This shifts leadership conversations from anxiety-driven to data-driven decision-making.

How Our Professionals Support Your Internal Financial Team

Cash flow stabilization in senior healthcare is most effective when it is treated not as an external intervention, but as a collaborative leadership effort that strengthens the organization from within. Senior living providers, skilled nursing facilities, CCRCs, and senior-focused NGOs already have dedicated finance professionals who understand their operations, culture, and mission. The challenge is rarely a lack of effort or commitment—it is the increasing complexity of reimbursement systems, regulatory oversight, workforce pressures, and real-time cash demands. In this environment, bringing in external expertise is not about replacing internal teams or taking control away from leadership. It is about augmenting internal capability, providing structure during periods of uncertainty, and helping organizations regain clarity and confidence in their financial decision-making.

Our professionals work alongside your internal finance team, executive leadership, and board as strategic partners, not temporary fixers. We recognize that sustainable cash flow stabilization cannot be achieved through short-term tactics or isolated actions. Instead, it requires alignment across finance, operations, and governance. By embedding ourselves into your existing workflows and decision processes, we ensure that stabilization efforts are grounded in your organization’s realities, values, and care priorities. Your finance team remains central to execution and long-term ownership, while we contribute specialized experience from complex senior healthcare environments, proven stabilization frameworks, and an objective, outside-in perspective that helps surface risks and opportunities that may be difficult to see from the inside.

1. We Act as Strategic Partners—Not Temporary Fixers

We do not take control away from your team.

We bring:

Experience from complex healthcare environments

Proven stabilization frameworks

An objective, outside-in perspective

Your finance team remains central to execution and long-term ownership.

2. We Translate Complexity into Actionable Decisions

- Turning raw data into decision-ready insights

- Explaining trade-offs clearly

- Aligning financial actions with care priorities

Senior healthcare finance is inherently complex, and that complexity often becomes a barrier to timely decision-making. One of the most valuable roles we play is translating financial complexity into clear, actionable insights for leadership. We help turn raw data—cash balances, aging reports, reimbursement trends, and forecasts—into decision-ready information that CEOs, executive directors, and boards can confidently act on. By clearly explaining trade-offs, timing implications, and risk exposure, we enable leadership to make informed choices without being overwhelmed by financial jargon or technical detail. This clarity is essential for aligning financial actions with care delivery goals, regulatory requirements, and organizational strategy.

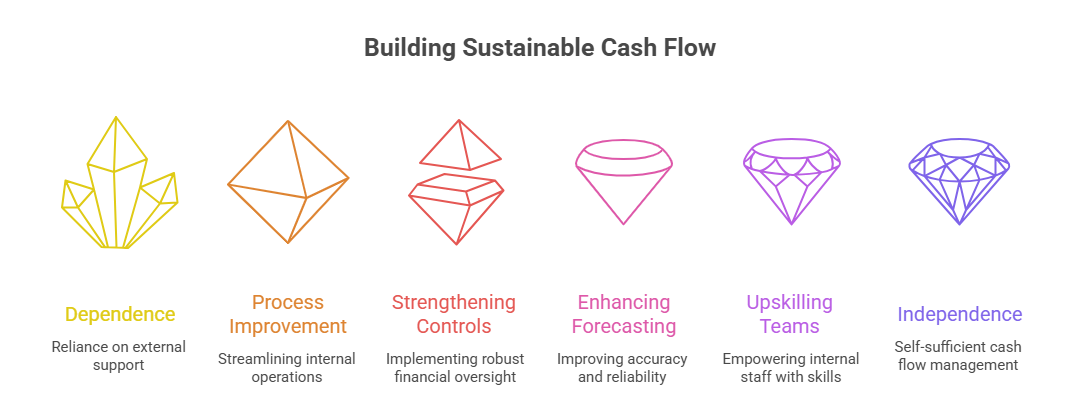

3. We Build Systems, Not Dependence

Every stabilization engagement focuses on:

Improving internal processes

Strengthening controls

Enhancing forecasting discipline

Upskilling internal teams

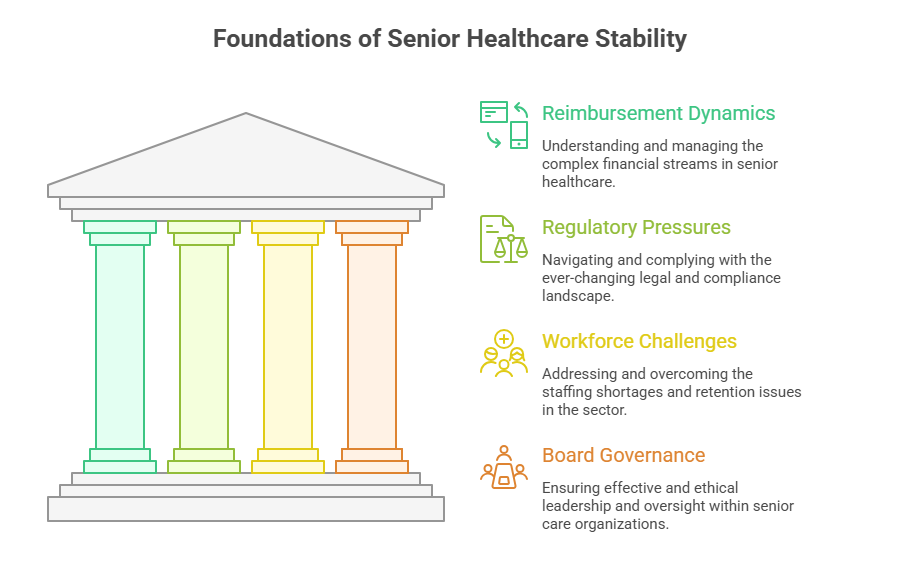

4. We Understand the Realities of Senior Healthcare

- Reimbursement dynamics

- Regulatory pressures

- Workforce challenges

- Board governance expectations

5. We Protect Care While Stabilizing Cash

Does this protect resident care and organizational mission?

When Should Senior Healthcare Organizations Consider Cash Flow Stabilization?

- Cash feels “tight” despite strong census

- Reimbursements are slowing

- Growth is planned but liquidity is uncertain

- Leadership wants better cash visibility

- Boards or lenders request stronger controls

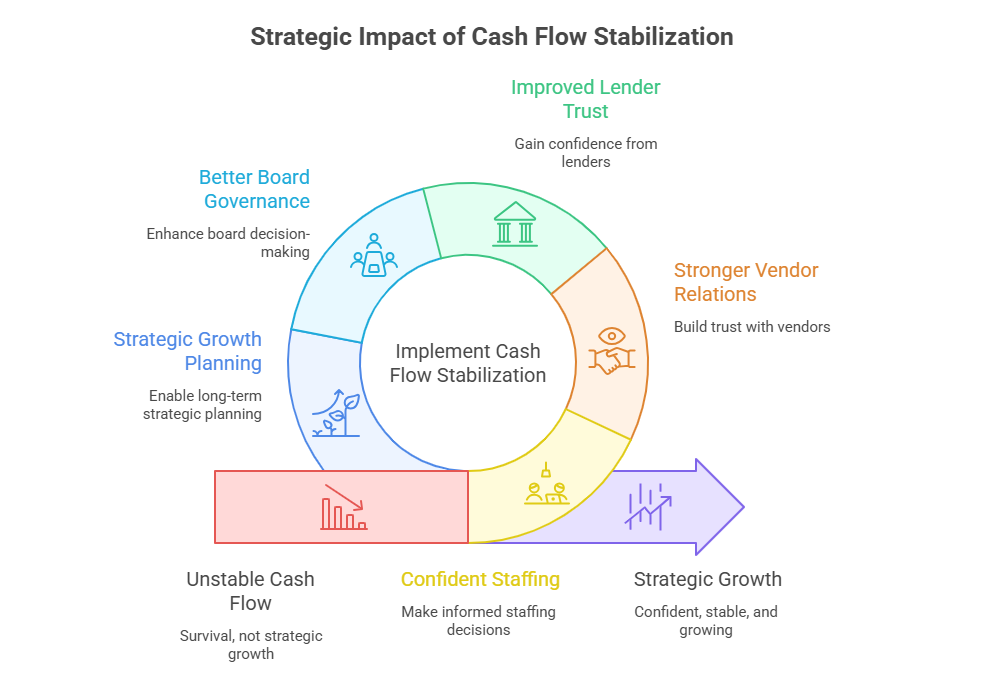

The Strategic Impact of Cash Flow Stabilization

- Confident staffing decisions

- Stronger vendor relationships

- Improved lender and donor trust

- Better board governance

- Strategic growth planning

Cash Stability Is Care Stability

Staff rely on it.

Boards are accountable for it.