Choosing the right accounting method is a critical financial decision that directly impacts how your business reports revenue, manages liquidity, and evaluates performance. The cash and accrual accounting methods represent fundamentally different approaches to recognizing financial activity.

While both are accepted under accounting standards, they yield vastly different insights. For small businesses, selecting the correct method determines not only tax implications but also financial visibility, credit readiness, and decision-making accuracy.

1. Understanding Cash Accounting

Cash-basis accounting records income and expenses solely at the point when money actually changes hands. It provides a real-time reflection of cash movement but omits obligations and receivables not yet settled.

Under cash accounting, revenues are recognized when payment is received from customers, and expenses are recognized when cash is disbursed to suppliers or vendors. This aligns with the cash receipts and disbursements journal concept used in accounting systems.

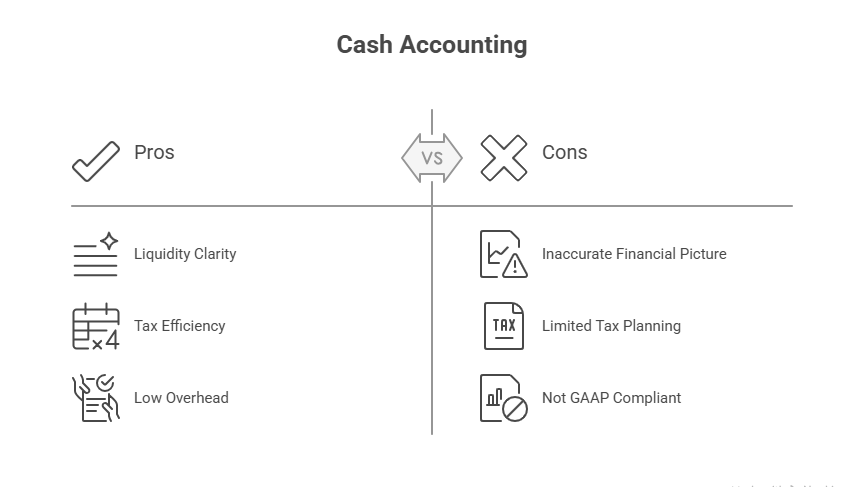

Advantages

Liquidity Clarity: The cash method directly aligns reported income with actual bank balances, giving an immediate view of working capital availability.

Tax Efficiency: Since income is only recognized when received, businesses can defer taxable income by controlling billing and collection timing.

Low Administrative Overhead: Simplified recordkeeping makes it suitable for microenterprises and service-based entities with minimal deferred income.

Limitations

Non-Matching Principle: Cash accounting violates the matching principle of accounting, as revenues and related expenses are not recognized in the same period.

Inaccurate Profitability Measurement: Periodic results can be distorted by timing differences in payments or receipts.

Limited Creditworthiness: Financial statements prepared under the cash basis often fail to meet lender or investor standards due to incomplete representation of assets and liabilities.

Appropriate Use Cases

Sole proprietorships and small partnerships with straightforward cash transactions.

Businesses operating primarily on a cash-collection model (e.g., small retailers, consultants).

Entities below the regulatory threshold requiring accrual-based reporting (as defined by GAAP or local tax codes).

2. Understanding Accrual Accounting

The accrual basis of accounting records transactions when they are earned or incurred, regardless of when cash is exchanged. It adheres to both the revenue recognition principle and the matching principle, providing a more comprehensive picture of financial performance.

Revenue is recognized when the business fulfills its performance obligations (per ASC 606 or IFRS 15), and expenses are recorded when the corresponding benefit is consumed, not when payment occurs.

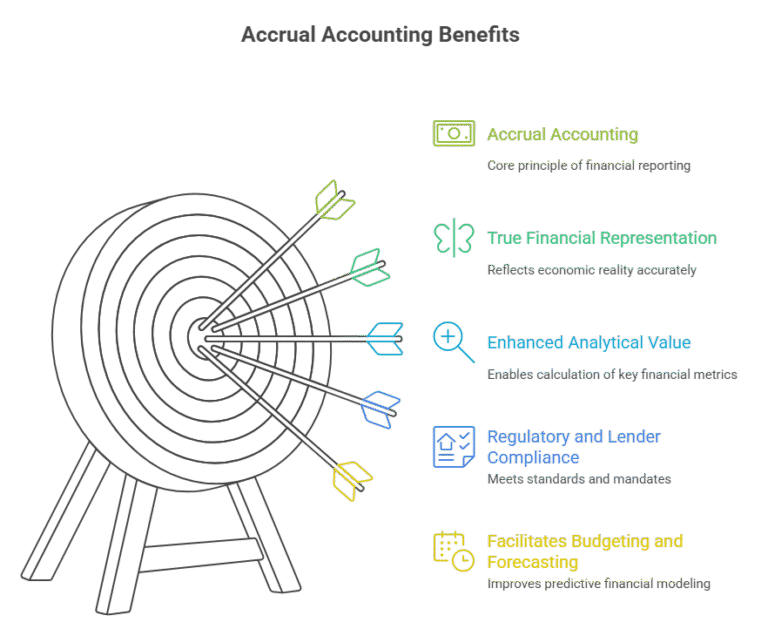

Advantages

True Financial Representation: Reflects economic activity rather than cash timing, ensuring that revenues and expenses correspond to the correct accounting periods.

Enhanced Analytical Value: Enables accurate computation of gross margin, operating income, and net profit—key indicators for management reporting and investor evaluation.

Regulatory and Lender Compliance: Required by Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), and often mandated by financial institutions.

Facilitates Budgeting and Forecasting: Since accruals recognize income and liabilities ahead of cash movement, they improve predictive financial modeling.

Limitations

Cash Flow Ambiguity: Accrual accounting can portray profitability even when cash reserves are low, leading to liquidity mismanagement if not monitored with cash flow statements.

Complex Implementation: Requires double-entry bookkeeping, adjusting entries (accrued expenses, deferred revenues), and systematic reconciliation.

Higher Maintenance Cost: Needs accounting software or professional oversight to maintain accuracy and compliance.

Appropriate Use Cases

Medium-to-large enterprises with recurring revenue, credit sales, or inventory.

Businesses seeking external funding, investor participation, or M&A readiness.

Entities under statutory audit or required to file GAAP-compliant financial statements.

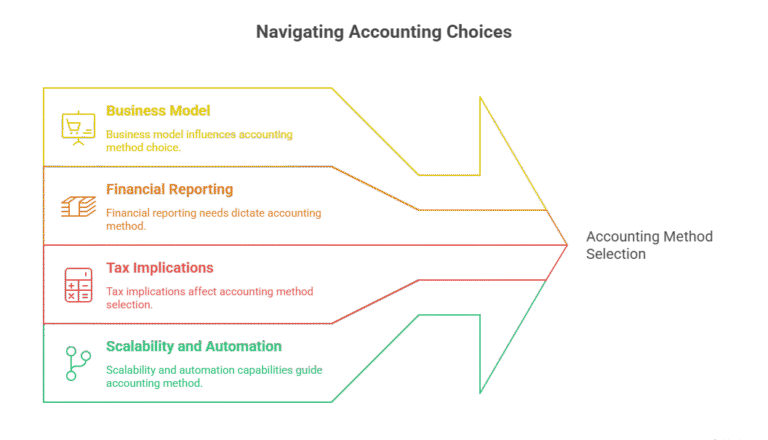

3. Decision Framework for Small Businesses

A. Business Model and Transaction Structure

If your business relies on upfront payments or cash-on-delivery, the cash basis simplifies reporting.

However, if you operate on credit terms, subscriptions, or contractual billing, accrual accounting aligns better with your revenue cycle.

B. Financial Reporting Requirements

Businesses preparing financial statements for banks, investors, or regulators must adopt the accrual basis to ensure compliance with GAAP. Cash accounting, while simpler, lacks the precision required for external reporting.

C. Tax Implications

Cash accounting allows tax deferral by recognizing income upon receipt, whereas accrual accounting accelerates tax liabilities since income is recognized when earned—even if payment is pending.

A hybrid or accrual method may be strategically advantageous for tax planning in businesses with deferred income or prepaid expenses.

D. Scalability and Automation

As businesses scale, accrual-based accounting integrates more effectively with ERP systems, FP&A tools, and automated reconciliation modules. This provides better alignment between operational data and financial metrics.

4. Hybrid Accounting: A Transitional Model

Hybrid accounting combines elements of both methods, often used during a transition phase.

For example:

Cash basis for routine transactions and small expenses.

Accrual tracking for inventory, major receivables, and deferred revenue.

This approach retains simplicity while enhancing visibility into financial commitments.

It’s particularly suitable for growing businesses that want to scale toward full accrual accounting without overhauling systems overnight.

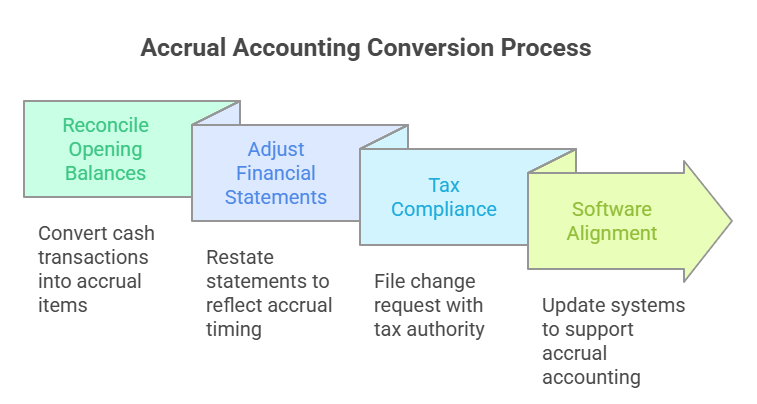

5. Transitioning Between Methods

Changing from cash to accrual accounting (or vice versa) requires systematic adjustments to ensure data integrity.

Key Steps:

Reconcile Opening Balances: Convert prior cash transactions into receivables, payables, and accrued items.

Adjust Financial Statements: Restate income statements and balance sheets to reflect accrual-based timing.

Tax Compliance: File a change request (Form 3115 in the U.S. or equivalent) with the tax authority.

Software Alignment: Update ERP or accounting platforms to support accrual recognition and reporting.

Failure to properly transition can lead to double-counting or misstatements in retained earnings.

6. Professional Recommendation

From a financial management standpoint, accrual accounting is the superior model for decision-making, forecasting, and performance analysis—especially as businesses grow in complexity.

However, cash accounting remains a valid choice for startups or sole proprietors seeking simplicity and direct cash visibility.

For best results, many small businesses begin with cash accounting and later transition to accrual under the guidance of a Fractional CFO or accounting automation specialist.

The choice between cash and accrual accounting defines how your business measures success and prepares for growth.

Cash accounting emphasizes liquidity; accrual accounting emphasizes performance. Both serve a purpose—but only one aligns with your strategic direction.

For small businesses aiming to scale, integrate automation, or attract investment, accrual accounting provides the analytical depth and financial discipline needed for sustainable expansion.

At S.K.I.L.L. Consultants, we assist small and mid-sized businesses in designing accounting systems tailored to their operational models.

From selecting the appropriate accounting method to automating accrual entries and generating compliance-ready reports, our experts ensure your financial data supports smarter, faster decisions.