1. Process Mapping and Current-State Assessment

The first phase involves a diagnostic review of existing financial workflows to understand how transactions, data, and decisions flow across the finance ecosystem.

We conduct:

Process walkthroughs with finance staff to capture real operational practices versus documented procedures.

System mapping to identify how ERPs, spreadsheets, and point solutions interact.

Bottleneck analysis to locate delays in approvals, reconciliations, and reporting cycles.

Risk identification to detect control gaps or dependency on key individuals.

This stage produces as-is process maps using tools, along with a process inventory and risk/control matrix. These visual and analytical tools highlight inefficiencies such as redundant approvals, duplicate data entry, and lack of audit trails.

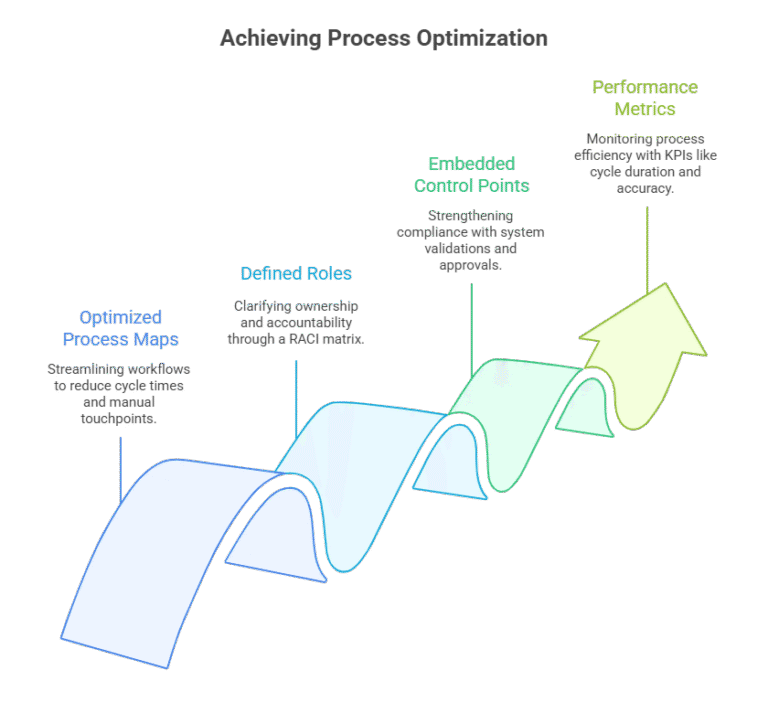

2. Process Redesign and Optimization

Once the baseline is established, we move to the process redesign stage.

Our goal is to align financial processes with industry best practices, regulatory requirements, and automation readiness. We employ Lean and Six Sigma principles to streamline workflows and eliminate non–value-added activities.

Key deliverables include:

Optimized process maps with reduced cycle times and fewer manual touchpoints.

Defined roles and responsibilities (RACI matrix) to clarify ownership and accountability.

Embedded control points (e.g., system validations, dual approvals, and reconciliation triggers) to strengthen compliance.

Performance metrics and KPIs (e.g., close-cycle duration, invoice processing cost, reconciliation accuracy) to monitor process efficiency.

This redesign ensures that financial workflows are standardized, measurable, and scalable — forming a stable foundation for automation.

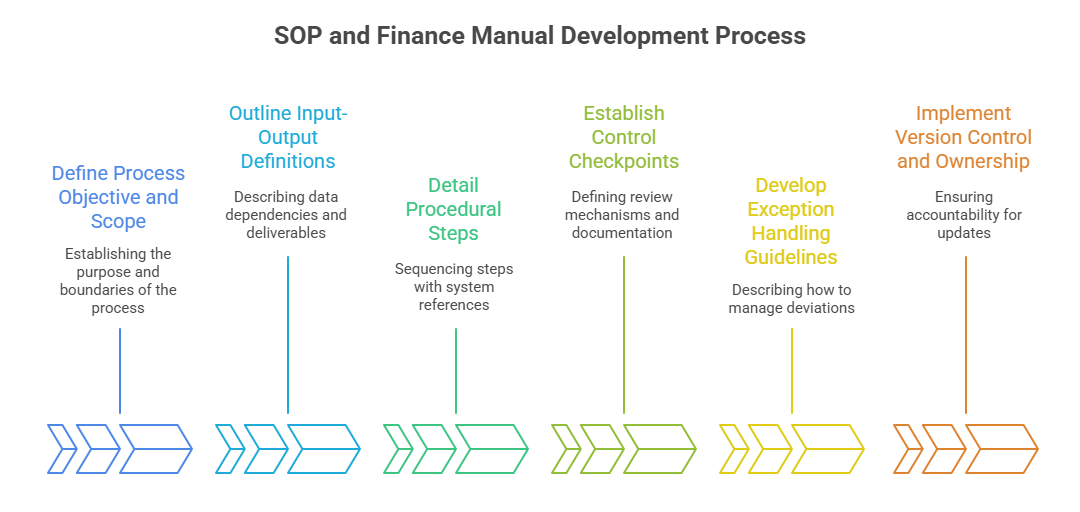

3. SOP and Finance Manual Development

We then translate optimized workflows into formal Standard Operating Procedures (SOPs) and a comprehensive Finance Operations Manual.

Each SOP includes:

Process objective and scope — defining its purpose and boundaries.

Input-output definitions — outlining data dependencies and deliverables.

Detailed procedural steps — sequenced in logical order with system references (ERP paths, approval hierarchies, etc.).

Control checkpoints — defining review mechanisms and documentation requirements.

Exception handling guidelines — describing how to manage deviations.

Version control and ownership structure — to ensure accountability for updates.

The Finance Operations Manual consolidates these SOPs into a unified reference framework — covering all finance domains such as payables, receivables, payroll, fixed assets, budgeting, and financial reporting.

This documentation standardizes operations across teams and facilities, ensures compliance readiness, and supports staff onboarding and audit processes.

4. Implementation and Training

Effective process transformation depends on adoption and behavioral alignment. We facilitate this through structured implementation and knowledge transfer programs.

Our approach includes:

Hands-on training workshops for finance staff and controllers to familiarize them with new procedures and documentation standards.

Process ownership sessions to instill accountability among process custodians.

SOP utilization training within the ERP or document management system.

Change management communication to ensure smooth transition from legacy practices to standardized processes.

We also provide performance monitoring templates to help teams evaluate adherence levels and identify areas needing reinforcement.

5. Selective Automation Post-Optimization

Automation is most effective when built on well-structured, documented processes. Once processes are standardized, we evaluate them for automation feasibility and ROI using a structured framework.

Typical automation opportunities include:

Accounts Payable Automation — integrating OCR-based invoice capture, auto-approval workflows, and three-way matching.

Bank Reconciliation Automation — using AI-enabled tools to auto-match transactions and flag exceptions.

Management Reporting Automation — generating standardized dashboards through BI tools (Power BI, Tableau, or Looker).

Close and Consolidation Automation — automating journal entries, intercompany eliminations, and variance reports.

We integrate these automations through RPA platforms or ERP-native workflow tools, depending on system maturity. The result is a controlled, auditable, and low-touch finance environment that improves accuracy while reducing manual workload.

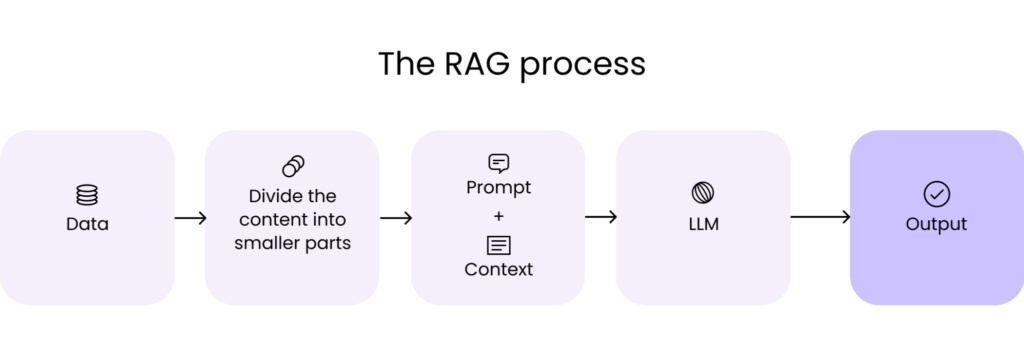

Tech Stack

Machine Learning

Programming & AI

SQL (Structured Query Language)

Power BI

Python

RAG models

6. Governance and Continuous Improvement Framework

SOPs and process documentation are not static. We establish a governance structure to ensure ongoing relevance and compliance.

This includes:

Version control systems for managing updates and approvals.

Scheduled process audits to validate adherence and control effectiveness.

Feedback loops for continuous improvement driven by metrics and staff insights.

Automation review cycles to evaluate performance and reconfigure bots as business rules evolve.

By institutionalizing governance, finance teams maintain documentation integrity and prevent process degradation over time.

7. Strategic Outcomes for Finance Leadership

Through structured process design, documentation, and automation, organizations achieve:

Accelerated financial closes with reduced manual intervention.

Improved data quality and audit readiness through standardized controls.

Enhanced operational scalability as processes become replicable across entities.

Reduced dependency on individuals by capturing institutional knowledge.

Greater analytical capacity as automation frees time for strategic FP&A activities.

We help finance departments transition from people-dependent to process-driven and technology-enabled functions.

By combining deep finance domain expertise, process engineering techniques, and automation technology, we deliver systems that are documented, optimized, compliant, and future-ready.

In essence, our approach transforms finance operations from “ad hoc execution” into a well-orchestrated digital finance framework — one where every activity is traceable, efficient, and scalable.