The financial landscape for healthcare operators—especially those managing multi-facility networks, senior care, or independent living centers—has never been more complex. Between evolving reimbursement models, rising operational costs, and tighter compliance standards, leadership teams are being pulled in multiple directions.

Traditional financial management models can’t keep up with today’s pace. Healthcare finance is now less about counting dollars and more about strategic transformation—using data, technology, and proactive planning to shape the future of care delivery.

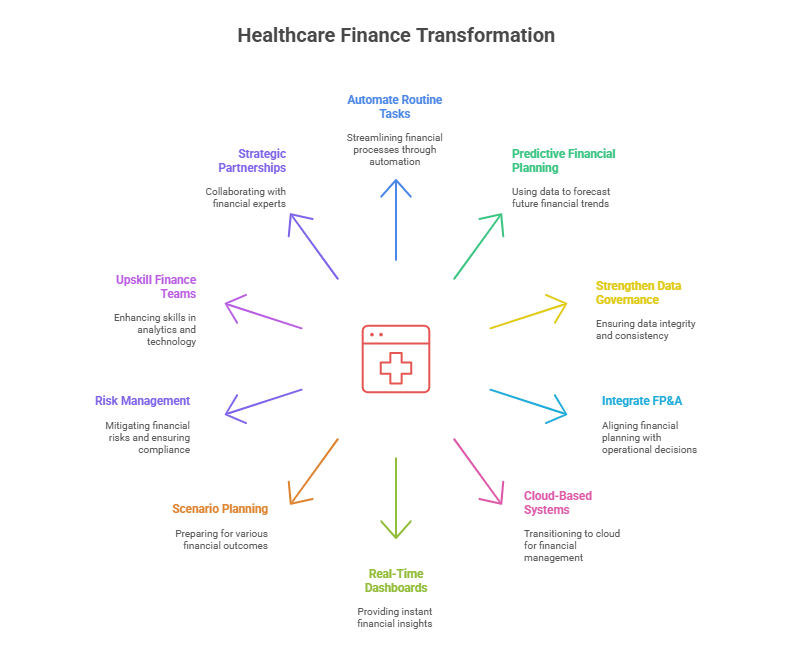

Here are 10 critical business changes every healthcare operator should consider to thrive in this complex financial world.

1. Automate Routine Financial Tasks to Reclaim Time and Accuracy

Healthcare finance teams often spend countless hours on manual tasks—account reconciliations, month-end closings, journal entries, and report preparation. These repetitive processes drain time that could be better spent on strategic analysis.

Automation tools can handle these functions seamlessly. From accounts payable automation that eliminates invoice bottlenecks to reconciliation bots that match transactions in seconds, automation reduces human error and speeds up processes.

For example, by automating reconciliations and reporting, a senior care group can close their books faster—turning what once took 20 days into a 5-day process. The result?

1. Faster insights

2. Fewer errors

3. More bandwidth for strategic planning

Automation doesn’t replace finance professionals—it frees them to focus on what truly matters: improving margins, optimizing staffing costs, and supporting patient care quality.

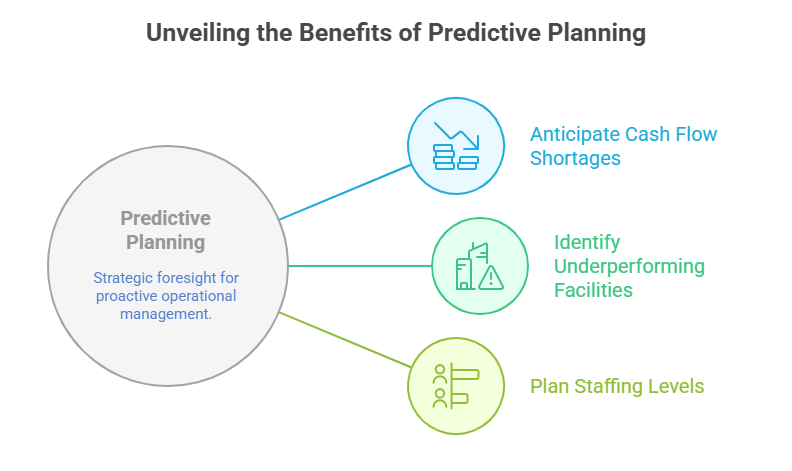

2. Shift from Historical Reporting to Predictive Financial Planning

In healthcare, historical reports tell you what happened last month. But in today’s volatile environment, leaders need to know what will happen next.

Predictive analytics transforms your finance function from reactive to proactive. It uses data trends—like census shifts, payer mix changes, and expense spikes—to forecast financial outcomes.

With predictive planning, operators can:

Anticipate cash flow shortages before they occur.

Identify early warning signs of underperforming facilities.

Plan staffing levels aligned with future census trends.

By adopting predictive forecasting models, your finance team becomes a strategic partner—not just a scorekeeper.

3. Strengthen Financial Data Governance and Consistency

Multi-facility organizations often struggle with fragmented financial data—different systems, formats, and reporting standards across sites. Without consistent data governance, comparing performance between facilities becomes nearly impossible.

Establishing financial data governance means defining one source of truth. Centralizing accounting systems, standardizing the chart of accounts, and implementing unified financial policies across facilities create transparency and accuracy.

When leadership has confidence in the numbers, they can make quicker, better-informed decisions about capital investments, facility expansions, and resource allocation.

4. Integrate FP&A with Operational Decision-Making

Finance should not operate in isolation from clinical and operational teams. The best-performing healthcare organizations bridge the gap between FP&A (Financial Planning & Analysis) and daily operations.

This integration allows finance teams to:

Translate operational data (like occupancy, length of stay, and staffing ratios) into financial insights.

Model “what-if” scenarios before making big decisions

Help administrators understand how operational shifts impact financial performance.

For example, FP&A can forecast how adjusting nurse-to-patient ratios might affect profitability without compromising care quality. When finance and operations move together, the organization becomes more agile and informed.

5. Transition to Cloud-Based Financial Systems

Legacy, on-premise accounting software struggles with scalability and accessibility—especially across multiple locations. Cloud-based financial platforms, such as NetSuite, Sage Intacct, or QuickBooks Enterprise, provide real-time visibility and central control for multi-facility operators.

With cloud systems, leadership can:

Access live financial dashboards from anywhere

Standardize reporting across all facilities

Enable secure collaboration between accountants, CFOs, and administrators

Cloud finance solutions also integrate seamlessly with EHRs and billing systems, creating a unified ecosystem of financial and operational intelligence.

6. Build Real-Time Dashboards and KPI Visibility

Traditional monthly reports often arrive too late to take action. By the time leadership reviews them, opportunities or problems have already passed.

Real-time financial dashboards solve that problem. They display live data on:

Occupancy rates and census trends

Labor utilization

Cash flow and AR aging

Payer performance metrics

Custom dashboards empower CFOs and executives to spot issues early—whether it’s rising overtime costs or declining reimbursement rates—and respond before they escalate.

When data is visual, real-time, and accessible, decision-making becomes faster and sharper.

7. Develop Scenario Planning and Stress Testing Capabilities

The healthcare industry is unpredictable—reimbursement changes, inflation, regulatory updates, and workforce shortages can all disrupt financial stability. Scenario planning helps you stay prepared.

By simulating “what-if” conditions, such as a 5% decline in occupancy or a new labor contract, finance teams can estimate the impact on cash flow, profitability, and covenant compliance.

Scenario planning gives leadership confidence under uncertainty—they can make decisions knowing they’ve already modeled potential outcomes.

This capability is crucial for board reporting and strategic discussions, allowing you to back every recommendation with data-driven foresight.

8. Strengthen Risk Management and Compliance Frameworks

In healthcare, compliance isn’t optional—it’s existential. From HIPAA to state-specific reimbursement audits, operators must maintain financial transparency and risk control at all times.

Enhancing your risk and compliance framework means:

Implementing internal financial controls across all locations

Conducting regular audit-readiness reviews

Tracking regulatory updates that affect reimbursement or reporting

Modern finance teams use compliance automation tools that monitor transactions for anomalies, flag potential violations, and maintain audit trails automatically.

This not only ensures compliance but also builds trust with investors, lenders, and regulators—a key factor in long-term sustainability.

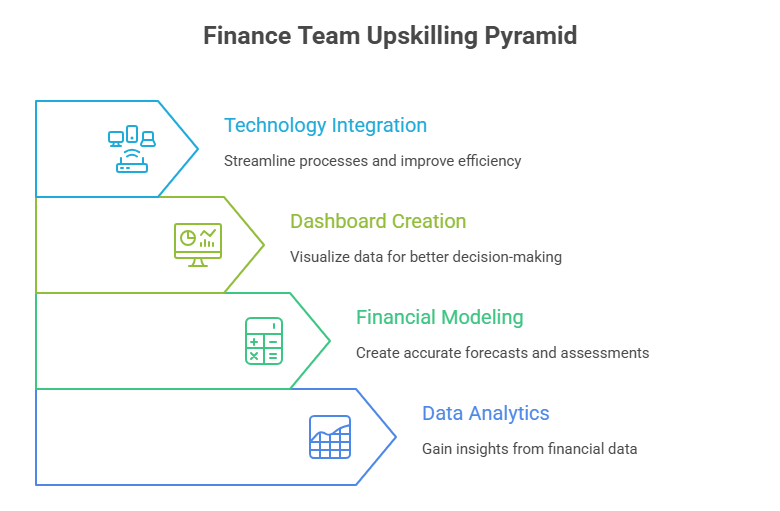

9. Up-skill Finance Teams in Analytics and Technology

Finance transformation isn’t just about tools—it’s about people. Many finance teams in healthcare were built around traditional accounting roles. Now, they need new skill sets:

Data analytics

Financial modeling

Dashboard creation

Technology integration

Encouraging continuous learning, training on new systems, and cross-functional collaboration builds a more adaptive, tech-savvy finance department.

A well-trained team can extract deeper insights from data, operate automation systems efficiently, and align financial insights with clinical goals.

When your finance team evolves, your entire organization becomes smarter, faster, and more competitive.

10. Collaborate with Strategic Financial Partners

Managing finance transformation internally can be overwhelming—especially for operators juggling compliance, clinical quality, and occupancy goals. Partnering with Fractional CFOs, outsourced FP&A teams, or bookkeeping automation providers can make the journey smoother.

Strategic partners bring:

Industry-specific expertise in healthcare finance

Scalable support without full-time overhead

Advanced tools for automation, forecasting, and reporting

For instance, a multi-facility senior care network might collaborate with a financial automation firm to integrate systems, build dashboards, and manage cash flow forecasting—allowing in-house teams to focus on operations and care delivery.

The result: a finance function that’s faster, leaner, and more insightful.

Bringing It All Together: Building a Future-Ready Finance Function

The healthcare world is complex—but your financial management doesn’t have to be. By embracing automation, predictive analytics, and data-driven insights, healthcare operators can move from reactive accounting to proactive financial strategy.

Each of these ten changes builds toward one outcome: clarity.

Clarity in your numbers. Clarity in your decisions. Clarity in your growth path.

In a world where every decision impacts both patient care and profitability, having a modern, connected, and forward-thinking finance function isn’t just a competitive advantage—it’s a necessity.

The organizations that adapt today will lead tomorrow’s healthcare landscape.

About S.K.I.L.L. Consultants

At S.K.I.L.L. Consultants, we specialize in helping healthcare operators transform their finance functions through automation, FP&A, and strategic CFO services. From building financial dashboards to automating reconciliations and streamlining reporting, we help multi-facility networks stay financially healthy and future-ready.

If you’re ready to modernize your financial operations and unlock actionable insights across your healthcare organization, let’s connect.