Why Strategy Needs Finance?

In today’s volatile business environment, companies are under pressure to make faster, smarter, and more future-focused decisions. Competitive landscapes shift overnight, regulatory frameworks evolve, consumer expectations change, and technology disrupts entire industries in a matter of months.

For leaders, this raises an urgent question: How do we chart a long-term course when the future itself feels uncertain?

The answer lies in Financial Planning & Analysis (FP&A). While accounting tells the story of yesterday, FP&A equips leaders with the insights to make tomorrow’s story successful. It’s the function that transforms numbers into strategy, guiding companies not just to survive, but to thrive in the long run.

What Exactly is FP&A?

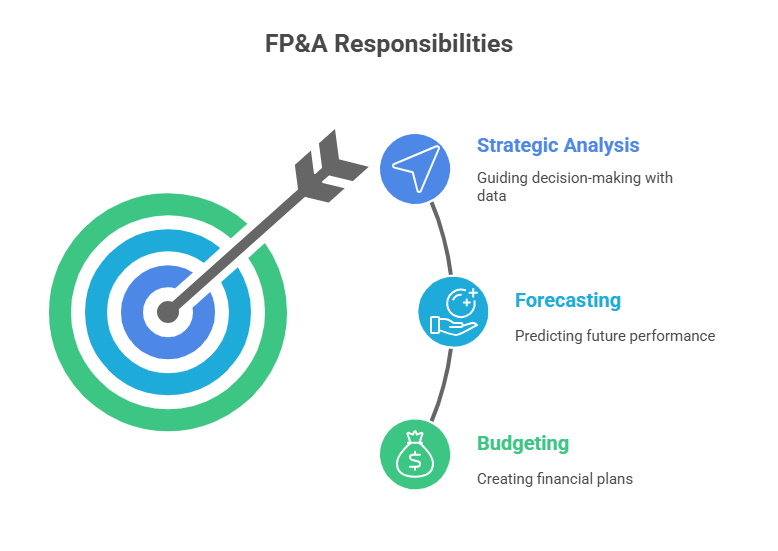

At its core, FP&A involves three fundamental responsibilities:

- Budgeting– Creating forward-looking financial plans that align with business priorities.

- Forecasting– Using historical data and predictive models to anticipate future performance.

- Strategic Analysis– Evaluating financial and operational data to guide decision-making.

Unlike traditional accounting, which is retrospective, FP&A is inherently forward-looking. It asks:

- Where should resources be deployed?

- What risks are on the horizon?

- Which growth opportunities are most profitable?

Think of FP&A as the compass of the organization. Without it, companies may have goals but lack the navigational tools to reach them. With it, organizations move with clarity, confidence, and agility.

Why FP&A Matters for Long-Term Strategy

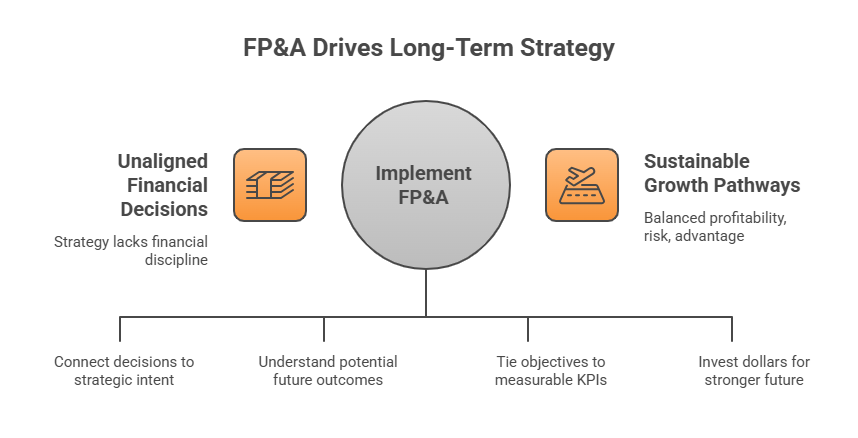

Long-term business strategy is more than setting ambitious goals. It’s about building sustainable growth pathways while balancing profitability, risk management, and competitive advantage.

Here’s where FP&A proves indispensable:

- It aligns financial decisions with strategic intent.No strategy is sustainable without financial discipline.

- It provides foresight.Leaders need to understand not just what’s happening now, but what could happen in different futures.

- It ensures accountability.Strategic objectives must be measurable and tied to KPIs.

- It optimizes capital use.FP&A makes sure every dollar invested today builds a stronger tomorrow.

Without a strong FP&A foundation, even the boldest strategies risk becoming castles built on sand.

5 Ways FP&A Fuels Long-Term Business Strategy

- Aligning Financial Goals with Strategic Objectives

Every organization has long-term ambitions: expanding into new markets, investing in digital transformation, improving margins, or enhancing shareholder value. But how do leaders ensure these objectives are financially feasible?

FP&A bridges this gap by:

- Linking budgets to corporate goals.

- Testing the financial sustainability of strategic initiatives.

- Ensuring resources are aligned with desired outcomes.

Example: Suppose a healthcare provider plans to build new senior-living facilities. FP&A evaluates the capital expenditure, projected revenue from occupancy rates, staffing costs, and payback periods. This ensures the expansion isn’t just aspirational—it’s financially viable.

- Forecasting and Scenario Planning

Markets are inherently uncertain. What happens if:

- Interest rates rise unexpectedly?

- A competitor launches an innovative product?

- Supply chain costs spike?

FP&A answers these questions through forecasting and scenario modeling. By simulating different “what-if” situations, leaders can prepare contingency plans.

Why it matters for long-term strategy:

- Scenario analysis prevents reactive decision-making.

- Companies can pivot quickly when external conditions shift.

- Investors and stakeholders gain confidence in leadership foresight.

Our FP&A professionals specialize in building dynamic scenario models, allowing companies to stress-test their strategies against multiple future states.

- Optimal Resource Allocation

Resources are always limited. FP&A ensures they’re deployed where they generate the highest long-term ROI.

This involves:

- Evaluating profitability across products, business units, or geographies.

- Identifying underperforming areas that drain resources.

- Reallocating capital toward high-growth opportunities.

Case in point: A retail chain may find that while online sales deliver higher margins, physical stores have declining footfall. FP&A insights can guide strategic reallocation—scaling e-commerce investment while optimizing the physical footprint.

By ensuring capital discipline, FP&A keeps companies focused on investments that truly drive strategic advantage.

- Tracking Performance Against KPIs

A strategy without measurement is just wishful thinking. FP&A defines and monitors Key Performance Indicators (KPIs) that directly tie to long-term goals, such as:

- Revenue growth rate

- Gross margin percentage

- Operating cash flow

- Return on invested capital (ROIC)

- Customer lifetime value

By continuously measuring these metrics, FP&A provides a feedback loop for strategy. Leaders can identify early warning signs, double down on successful initiatives, and refine approaches as needed.

Our FP&A teams not only track KPIs but also visualize them in real-time dashboards, ensuring executives always have their finger on the pulse of performance.

- Supporting Executive Decision-Making

Strategic decisions—like acquisitions, geographic expansion, or launching a new product line—carry high stakes. FP&A equips executives with:

- Financial models showing potential risks and rewards.

- Sensitivity analyses revealing critical assumptions.

- Recommendations grounded in data, not intuition.

This transforms boardroom discussions from speculative debates into evidence-based strategy sessions.

In short, FP&A empowers leaders to make bold decisions with confidence, knowing they’re backed by rigorous analysis.

How Technology is Elevating FP&A in Strategy

The role of FP&A has evolved dramatically with advances in technology. Where finance teams once spent weeks consolidating spreadsheets, today’s FP&A professionals leverage:

- Automation– Eliminating manual data entry and reconciliation.

- Advanced Analytics– Using predictive models to uncover trends.

- Artificial Intelligence (AI)– Enhancing forecasting accuracy with machine learning.

- Cloud Dashboards– Delivering real-time insights accessible across the organization.

This shift allows FP&A teams to spend less time crunching numbers and more time on strategic analysis.

Our company integrates these tools into client engagements, ensuring that organizations not only receive faster insights but also smarter, future-oriented recommendations.

Why Partner with S.K.I.L.L. Consultants FP&A Professionals?

Many businesses understand FP&A’s importance but struggle to build in-house expertise. Hiring, training, and retaining top FP&A talent requires significant investment. That’s where our company comes in.

We provide FP&A as a strategic service, giving businesses access to world-class professionals without the overhead of maintaining large finance teams.

Here’s why companies choose us:

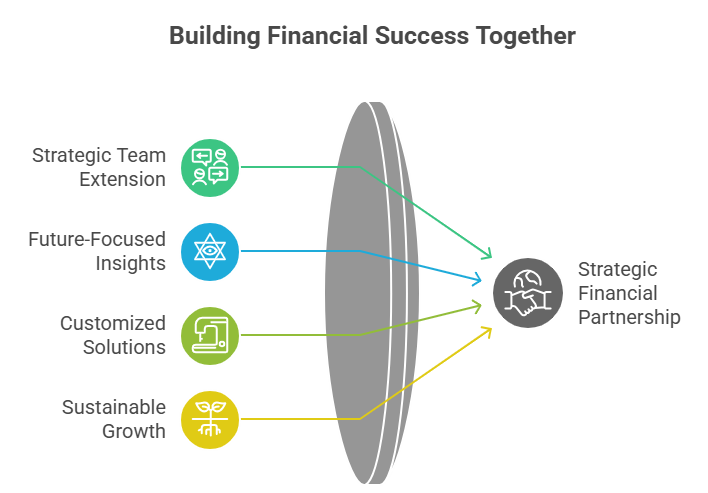

Strategic Extension of Your Team

Our FP&A professionals don’t operate in isolation. They embed themselves in your leadership processes, becoming trusted advisors who understand both your financials and your vision.

Future-Focused Insights

We deliver advanced forecasting, scenario planning, and KPI tracking—tailored specifically to your industry and market conditions.

Customized Solutions

No two businesses are alike. Instead of one-size-fits-all reports, we provide insights aligned with your unique goals, challenges, and opportunities.

Sustainable Growth Mindset

We’re more than number-crunchers. We help ensure today’s decisions are building a resilient, profitable future for your company.

In short, working with our FP&A professionals means gaining a strategic partner committed to turning financial insights into long-term success.

FP&A in Action: Real-World Applications

To illustrate FP&A’s impact, consider a few industry examples:

- Healthcare & Senior Living:FP&A models occupancy trends, reimbursement changes, and staffing costs to guide facility expansion strategies.

- Technology Startups:FP&A helps founders balance aggressive growth with cash burn management, ensuring capital lasts until the next funding round.

- Manufacturing:FP&A evaluates supply chain risks, production efficiency, and capital investment returns to support lean and scalable growth.

- Retail & E-Commerce:FP&A monitors customer acquisition costs, gross margins, and logistics expenses to align expansion with profitability.

In each case, the common thread is clear: FP&A connects vision with numbers, enabling leaders to act with clarity and foresight.

The Future of FP&A in Strategy

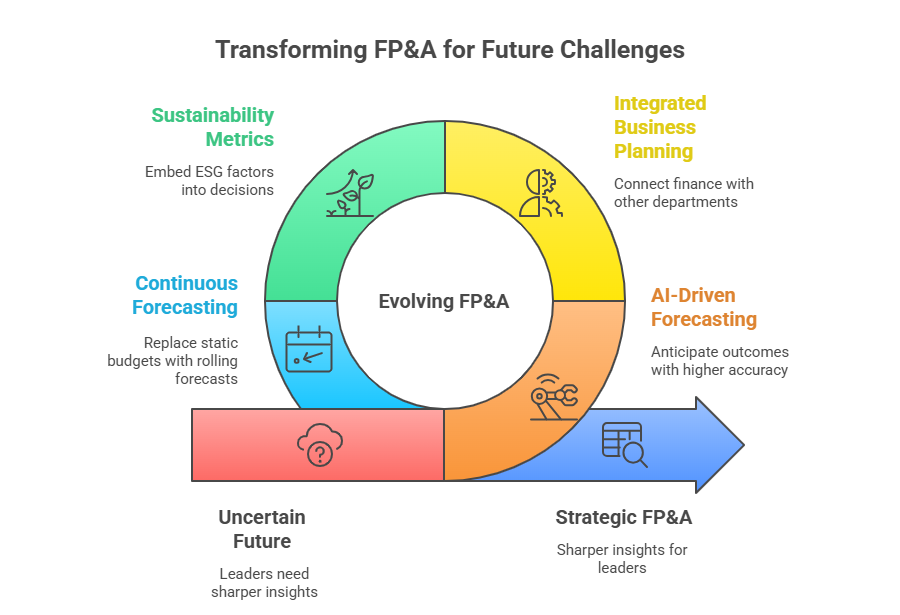

Looking ahead, FP&A will only become more critical. As uncertainty increases—from climate change to geopolitical tensions to technological disruption—leaders need sharper insights than ever.

Future trends shaping FP&A include:

- AI-Driven Predictive Forecasting– Anticipating outcomes with higher accuracy.

- Integrated Business Planning (IBP)– Connecting finance with sales, operations, and HR planning.

- Sustainability Metrics– Embedding ESG factors into financial decision-making.

- Continuous Forecasting– Replacing static annual budgets with rolling forecasts.

Our company is already helping clients embrace these innovations, positioning them ahead of the curve in strategic financial planning.

Long-term business strategy cannot succeed without a strong financial backbone. FP&A is that backbone.

By aligning financial planning with strategic objectives, preparing for uncertainty, optimizing resources, and supporting executive decisions, FP&A ensures that businesses don’t just have ambitious goals—they have the financial pathways to achieve them.

And when you partner with our FP&A professionals, you gain more than data analysis. You gain a strategic ally who ensures every financial decision builds a stronger, more sustainable future.

In an era where the only constant is change, FP&A provides the clarity, confidence, and foresight that long-term success demands.