Running a small business is both exciting and challenging. While you’re focused on serving customers, scaling operations, and innovating, there’s one area that can make or break your success: accounting. Too often, entrepreneurs push financial management to the background—until they’re forced to deal with tax penalties, unpaid invoices, or cash flow crises.

The truth is, good accounting practices are not just about compliance. They are the foundation of smart decision-making, sustainable growth, and long-term profitability. Whether you’re starting out or expanding into new markets, having the right systems in place will save you time, money, and stress.

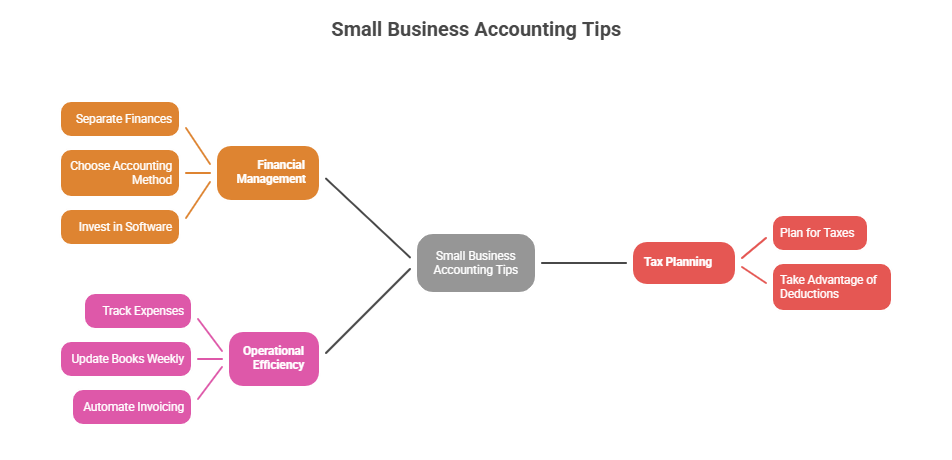

S.K.I.L.L. Consultants Experts Say : 21 Essential Small Business Accounting Tips Every Business Owner Should Follow:

1. Separate Business and Personal Finances

Mixing personal and business money is a recipe for disaster. It clouds your financial picture, complicates taxes, and may even put your personal assets at risk.

Action Step: Open a business bank account and business credit card. This keeps records clean, simplifies tax preparation, and builds credibility with banks and investors.

2. Choose the Right Accounting Method Early

Your accounting method shapes how you record and view finances:

Cash-Basis Accounting – Record income and expenses when money actually changes hands.

Accrual-Basis Accounting – Record income when earned and expenses when incurred, regardless of payment.

Tip: Many small businesses start with cash-basis because it’s simpler, but accrual gives a clearer view of financial health. Decide early to avoid painful transitions later.

3. Invest in Cloud Accounting Software

Gone are the days of manual spreadsheets. Platforms like QuickBooks, Xero, FreshBooks, and Zoho Books offer automated invoicing, payroll, reporting, and tax tracking.

With cloud tools, you can:

Access data anytime, anywhere

Reduce manual entry errors

Get real-time insights

Share access with accountants or bookkeepers securely

4. Track Every Expense—No Matter How Small

Those $10 coffee meetings, $20 parking fees, or small subscriptions add up. Overlooking them can distort profitability and shrink tax deductions.

Action Step: Use receipt-tracking apps (Expensify, Hubdoc) or connect your bank feeds to your accounting software for automatic tracking.

5. Keep Your Books Updated Weekly

Waiting until tax season to organize records is a guaranteed headache.

Tip: Dedicate time every week to record income, categorize expenses, and reconcile accounts. This keeps your books accurate and prevents year-end chaos.

6. Reconcile Bank Accounts Monthly

Bank reconciliation compares your accounting records with bank statements. It ensures no transactions are missed and catches errors or fraud early.

Action Step: Make this a monthly routine—it only takes minutes but saves big headaches later.

7. Build and Maintain a Cash Reserve

Even profitable businesses can run into cash shortages due to late payments or unexpected costs.

Best Practice: Keep at least 3–6 months of operating expenses in a reserve account. It’s your safety net during tough times.

8. Monitor Cash Flow Like a Hawk

Profit doesn’t always equal liquidity. You can look profitable on paper yet still struggle to pay bills if cash is tied up in receivables.

Tip:

Create a rolling 13-week cash flow forecast

Track inflows (sales, receivables) and outflows (expenses, payroll, taxes)

Use forecasts to anticipate shortfalls before they happen

9. Plan for Taxes Year-Round

Many business owners scramble during tax season because they haven’t planned ahead.

Smart Steps:

Set up a separate “tax account” and transfer a percentage of revenue regularly

Stay on top of quarterly estimated tax deadlines

Consult a tax professional to maximize deductions and minimize liabilities

10. Take Advantage of Tax Deductions

Every missed deduction is lost money. Common deductions include:

Home office expenses

Vehicle mileage

Business meals and travel

Software and tools

Professional services

Tip: Keep meticulous records to ensure you claim everything you’re entitled to.

11. Consider Hiring a Bookkeeper

DIY accounting works at the beginning, but as your business grows, it becomes overwhelming. A professional bookkeeper ensures accuracy and saves you time better spent on strategy and sales.

Perspective: Think of bookkeeping costs as an investment, not an expense.

12. Create and Follow a Budget

Budgets aren’t just for corporations—they’re vital for small businesses too.

Action Plan:

Compare budget vs. actuals every month

Adjust quickly if spending goes off-track

Use insights to prioritize profitable growth initiatives

13. Review Financial Statements Monthly

Your three key statements tell the story of your business:

Income Statement – Are revenues covering costs?

Balance Sheet – Do assets outweigh liabilities?

Cash Flow Statement – Can you meet upcoming obligations?

Tip: Reviewing these monthly helps spot red flags before they turn into crises.

14. Automate Invoicing and Payments

Late payments hurt cash flow. Automating invoices and reminders speeds up collections.

Practical Steps:

Set up recurring invoices

Offer online payment options

Send automated reminders for overdue bills

15. Stay on Top of Accounts Receivable

Don’t let unpaid invoices pile up.

Best Practices:

Send polite reminders promptly

Offer discounts for early payments

Enforce a late payment policy

16. Manage Business Debt Responsibly

Debt can fuel growth—but unmanaged debt drains cash.

Tips:

Borrow for growth, not daily operations

Track repayment schedules closely

Refinance high-interest loans when possible

17. Stay Compliant with Regulations

From payroll taxes to business licensing, compliance errors are costly.

Checklist:

Stay updated on federal, state, and local tax rules

Understand payroll obligations

Use payroll services if compliance feels overwhelming

18. Prepare for Seasonal Fluctuations

Seasonality affects cash flow in industries like retail, landscaping, or tourism.

Plan Ahead:

Forecast seasonal dips

Save during peak months

Adjust staffing and expenses accordingly

19. Track KPIs to Guide Growth

Key financial metrics give clarity on performance and opportunities:

Gross Profit Margin

Current Ratio

Accounts Receivable Turnover

Customer Acquisition Cost

Tip: Review KPIs regularly to guide smart growth decisions.

20. Protect Your Business with Insurance

Unforeseen risks—from theft to lawsuits—can cripple your finances.

Coverage to Consider:

General liability

Professional liability

Workers’ compensation

Property insurance

21. Work with a Fractional CFO or Advisor

Beyond bookkeeping, a Fractional CFO brings strategic insights into long-term planning, profitability, and fundraising. Even part-time, this role can transform your growth trajectory.

Strong accounting practices aren’t just about compliance—they’re about confidence, clarity, and control. By separating finances, keeping books updated, tracking cash flow, and planning ahead, small business owners can avoid costly mistakes and focus on growth.

Remember: you don’t have to do it all alone. With the right tools, support from professionals, and these 21 tips, you can build a financial foundation that’s not only stable but scalable.