Introduction: Why Financial Forecasting Defines Competitive Success

In today’s economy, businesses are navigating an environment that is faster, riskier, and more complex than ever before. Whether you’re leading a healthcare network that needs to balance rising costs with patient care, managing retail outlets with seasonal volatility, or overseeing a real estate portfolio subject to market cycles, the one constant is uncertainty. In this climate, financial forecasting is no longer a back-office routine—it is a strategic weapon.

Forecasting provides the visibility leaders need to anticipate risks, seize opportunities, and stay competitive. Yet for many organizations, forecasting is still synonymous with hours of spreadsheet wrangling, manual reconciliations, and rushed assumptions. Traditional methods are slow, fragile, and unable to keep pace with real-time market shifts.

This is where automation changes everything. Automated financial forecasting transforms outdated processes into intelligent, data-driven insights that guide leaders with confidence. At S.K.I.L.L. Consultants, we’ve built an automation solution designed to empower finance teams, streamline forecasting, and give businesses a genuine competitive edge. By blending AI-powered predictions, seamless integration, and scenario modeling, we enable leaders to shift from reactive to proactive—turning uncertainty into opportunity.

- Why Forecasting Matters More Than Ever

Forecasting is the heartbeat of modern financial strategy. It’s not about predicting the future with perfect accuracy—it’s about preparing organizations to adapt and thrive under changing conditions.

Here are the key reasons forecasting has become indispensable:

- a) Cash Flow Management

Cash is the lifeblood of any organization. Forecasting helps leaders anticipate inflows and outflows, ensuring that obligations like payroll, supplier payments, and debt service are met without disruption. For industries like healthcare or nonprofits—where reimbursement cycles and donations can be unpredictable—cash flow visibility prevents crises before they happen.

- b) Resource Allocation

Every organization has limited resources. Forecasting aligns budgets with strategic priorities, ensuring money is deployed where it delivers maximum impact. Whether it’s funding new construction, expanding into a new market, or scaling technology infrastructure, accurate forecasting enables confident, strategic allocation.

- c) Risk Mitigation

From inflation and supply chain breakdowns to interest rate hikes and regulatory changes, external shocks are inevitable. Forecasting allows businesses to model potential risks and build buffers. For instance, senior living operators can simulate occupancy dips, while real estate investors can model interest rate scenarios. The ability to prepare for these disruptions often determines survival.

- d) Growth Planning

Forecasting isn’t just about surviving—it’s about growing. By identifying when and where to invest, organizations can expand strategically, optimize capital structure, and maximize returns. It’s the forward-looking lens that fuels innovation and sustainable expansion.

Yet, despite its importance, many finance teams are stuck in a cycle of manual forecasting. A 2023 survey found that over 70% of finance professionals spend most of their time collecting data instead of analyzing it. This leaves little bandwidth for strategy. The result? Missed opportunities, poor risk management, and reactive decision-making.

This is where automation steps in and resets the game.

- The Pitfalls of Traditional Forecasting

Before understanding why automation is the future, it’s important to recognize the limitations of the past. Traditional forecasting—built on spreadsheets, manual reconciliations, and siloed data—comes with serious drawbacks:

- a) Error-Prone

Human error is unavoidable when juggling thousands of rows of data. A misplaced decimal, a broken formula, or a copy-paste mistake can distort entire projections. History is filled with examples of companies losing millions due to spreadsheet mistakes.

- b) Time-Consuming

Building, updating, and maintaining manual forecasting models can take weeks. By the time the forecast is complete, market conditions may have already shifted. This lag leaves leaders reacting to outdated information.

- c) Static and Quickly Outdated

Most companies still create forecasts annually or quarterly. But markets don’t move in neat, quarterly increments. A forecast that sits untouched for months is irrelevant in volatile conditions.

- d) Lack of Transparency

Siloed data across departments makes it hard to see the full picture. Sales may have their numbers, operations another, and finance yet another. This fragmented view erodes confidence in the forecast.

The end result? Finance teams spend most of their days chasing numbers instead of delivering insights. Strategic decision-making suffers, and businesses lose ground to competitors who can act faster.

- What Is Automated Financial Forecasting?

Automated financial forecasting is not about replacing finance teams—it’s about equipping them with smarter tools. At its core, it uses artificial intelligence, machine learning, and process automation to collect, process, and analyze financial data.

Instead of spending hours pulling numbers into spreadsheets, finance leaders can instantly access real-time projections and run “what-if” analyses with a few clicks.

Key features include:

- Data Integration – Automated systems connect directly with accounting, ERP, CRM, and even banking platforms, ensuring one single source of truth.

- Predictive Analytics – Historical patterns, seasonality, and external factors like inflation or market trends are automatically factored into forecasts.

- Scenario Planning – Businesses can simulate different conditions: What if sales fall 15%? What if supply costs rise? What if expansion accelerates?

- Continuous Updates – Unlike static spreadsheets, automated forecasts refresh in real-time as transactions and new data flow in.

At S.K.I.L.L. Consultants, we unify these capabilities into one platform. Our solution is designed for leaders who want forecasts that are accurate, dynamic, and strategic.

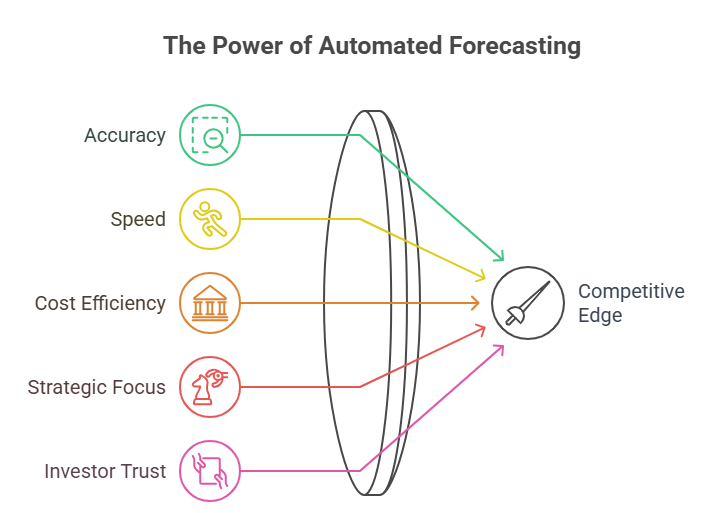

- The Competitive Edge of Automated Forecasting

Why does automation matter so much? Because it delivers advantages that manual methods simply cannot match:

- a) Accuracy That Builds Confidence

Automation eliminates the human errors that plague spreadsheets. By relying on comprehensive, clean data, leaders can trust their forecasts and make decisions confidently.

- b) Speed That Enables Agility

Weeks of manual work are reduced to real-time insights. This agility is critical when markets shift quickly—leaders can pivot strategies without hesitation.

- c) Cost Efficiency

By reducing manual workloads, organizations save both time and labor costs. Just as importantly, they avoid expensive mistakes caused by faulty forecasts.

- d) Strategic Focus

Automation frees finance teams from data entry drudgery. Instead, they can focus on higher-value tasks: analyzing scenarios, advising leadership, and driving growth strategies.

- e) Investor & Stakeholder Trust

Accurate, transparent forecasting builds credibility with investors, lenders, and partners. For industries like healthcare and real estate, where external stakeholders scrutinize financial health, this credibility can mean better financing terms and stronger partnerships.

In short, automation doesn’t just improve forecasts—it strengthens the entire organization’s ability to compete.

5. How Our Automation Solution Works

At S.K.I.L.L. Consultants, our forecasting automation was designed with one purpose: to give finance leaders clarity and control.

Here’s how our system empowers businesses:

-

Seamless Integration – Our platform connects directly to your accounting software, ERP, and even bank feeds. No more fragmented data silos.

-

Real-Time Forecasting – As soon as new transactions occur, your forecasts update automatically. Leaders always see the most current picture.

-

Custom Dashboards – Visual, intuitive dashboards translate numbers into actionable insights for CFOs, managers, and stakeholders.

-

Scenario Modeling – Finance teams can run unlimited “what-if” scenarios without rebuilding spreadsheets from scratch.

-

AI-Powered Predictions – Our algorithms don’t just look at the past—they anticipate trends, seasonality, and industry benchmarks.

The result is forecasting that is smarter, faster, and more reliable than ever before.

Why Businesses Can’t Afford to Delay

Every day spent relying on manual forecasting is a day spent:

-

Wasting time on repetitive, error-prone tasks.

-

Making decisions based on outdated information.

-

Falling behind competitors already leveraging automation.

Financial automation is not a passing trend—it’s a necessity. The sooner businesses adopt it, the sooner they unlock competitive advantage.

The Human Side: Empowering Finance Teams

Some worry that automation will replace people. The truth is the opposite: automation enhances finance teams. By removing repetitive tasks, it allows professionals to step into more strategic roles:

-

Interpreting data instead of compiling it.

-

Advising leadership with deeper insights.

-

Leading growth initiatives with confidence.

Automation doesn’t diminish finance teams—it elevates them.

Smarter Forecasts = Stronger Businesses

Financial forecasting has moved beyond static spreadsheets and educated guesses. Today, it’s about agility, accuracy, and confidence. With automation, businesses can see further, act faster, and achieve stronger results

At S.K.I.L.L. Consultants, we don’t just provide a tool—we provide a competitive edge. Our financial automation solution empowers organizations to forecast with confidence, reduce risks, and seize opportunities.

Smarter forecasts truly do lead to stronger businesses.

Are you ready to elevate your forecasting? Schedule a free consultation with us today.