Introduction: Why Budgeting Needs a New Approach

Budgeting has always been the cornerstone of financial management. Whether for individuals, growing businesses, or global organizations, a budget provides the foundation for planning, monitoring, and achieving financial goals. It acts as a roadmap, helping decision-makers allocate resources, control expenses, and prepare for the future.

Yet, despite its importance, traditional budgeting methods are increasingly failing to keep up with modern financial realities. The old approach—filled with spreadsheets, manual data entry, and static assumptions—was designed for a slower, less dynamic world. In today’s environment, where markets shift rapidly, consumer behavior evolves overnight, and unexpected events reshape financial landscapes, a rigid budget often loses relevance before it is even fully approved.

Artificial Intelligence (AI) is changing this. Unlike traditional methods that look backward at historical data, AI brings forward-looking intelligence. It adapts in real time, analyzes vast amounts of information quickly, and continuously refines predictions. The result is a budgeting process that is no longer reactive, but proactive—a system that evolves with circumstances and empowers decision-makers with sharper insights.

This article will explore in detail how AI is reshaping budgeting, why traditional methods are no longer enough, the benefits of adopting AI-driven budgeting, the challenges to consider, and the future outlook for financial planning in an AI-driven world.

The Traditional Budgeting Struggle

For decades, budgeting has been treated as an annual ritual. Finance teams would collect data, review historical records, make assumptions about future performance, and compile everything into spreadsheets. These budgets were then debated, revised, and eventually finalized after weeks—or even months—of work.

But the process itself comes with serious drawbacks:

-

Static Assumptions

Budgets rely on assumptions about revenues, expenses, and growth that are often made months in advance. The problem is that conditions change constantly. What looked accurate six months ago may no longer reflect reality today. This disconnect leads to outdated projections that reduce the budget’s usefulness.

-

Manual Data Entry Errors

Traditional budgeting requires constant human input—numbers entered into spreadsheets, calculations adjusted by hand, and multiple versions passed between teams. Even small errors in one cell can cascade into significant inaccuracies, creating misleading results and wasting valuable time to track down mistakes.

-

Lack of Agility

A rigid budget makes it difficult to respond to sudden changes—whether a market downturn, supply chain disruption, or unexpected spike in demand. By the time revisions are made, opportunities or risks may have already passed.

-

Resource Drain

Finance teams spend countless hours gathering data, formatting spreadsheets, and running endless iterations. This leaves less time for analyzing performance, exploring strategy, and advising leadership. Instead of driving value, most of their energy goes into maintaining outdated systems.

Because of these challenges, the traditional approach often feels like a box-checking exercise rather than a living document that supports decision-making. Businesses need something faster, more accurate, and more adaptable.

What is AI Budgeting?

AI budgeting refers to the use of artificial intelligence, predictive models, and machine learning techniques to transform budgeting into a smarter, more adaptive process. Unlike traditional budgeting, which relies heavily on historical data and static assumptions, AI budgeting continuously updates itself as new data emerges.

Key capabilities include:

-

Data Collection and Processing – AI can handle large volumes of information far faster than humans. It brings together data from multiple sources and organizes it in a usable format.

-

Pattern Recognition – AI identifies trends, inefficiencies, and spending behaviors that humans might overlook.

-

Predictive Forecasting – Instead of simply projecting based on the past, AI anticipates future outcomes by combining historical performance with current and external variables.

-

Dynamic Adjustment – Budgets evolve in real time. As new data becomes available, AI recalculates projections, ensuring decision-makers always work with the most relevant insights.

In this sense, AI does not replace financial leaders or strategic thinking. Instead, it enhances them by providing deeper, more accurate, and more timely insights. It acts like an intelligent co-pilot, helping businesses navigate uncertainty with greater confidence.

How AI Transforms Budgeting

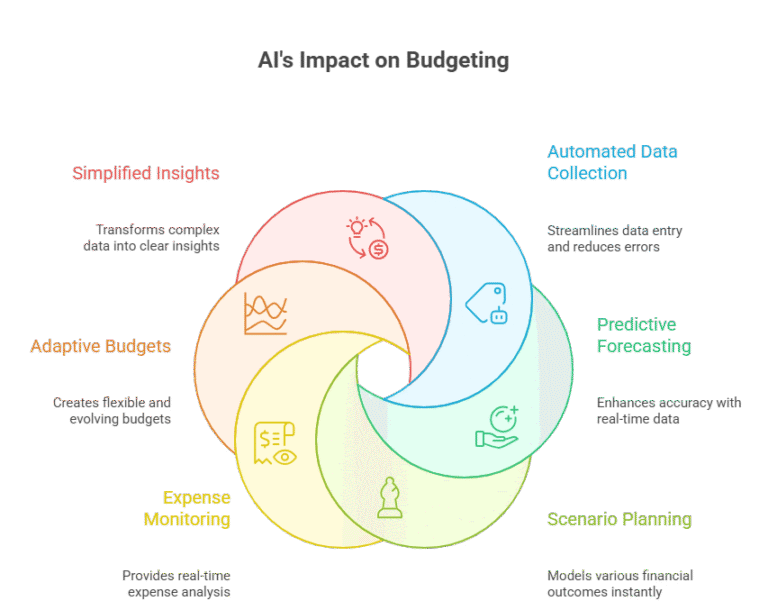

AI’s impact on budgeting can be understood through several core transformations:

1. Automated Data Collection and Entry

Traditional budgeting requires endless hours of manual data entry. AI eliminates this by automatically gathering and processing financial data. This automation reduces human error, ensures consistency, and gives teams more time for higher-value work.

2. Predictive Forecasting

AI uses predictive models to forecast revenue, expenses, and cash flows. These forecasts are not limited to past performance but incorporate current conditions and external factors such as inflation, consumer demand shifts, and broader economic changes. Predictions become more accurate, forward-looking, and context-aware.

3. Scenario Planning

“What if” questions are central to financial planning. What happens if sales drop? What if expenses rise unexpectedly? Traditionally, answering these questions required hours of recalculations. AI allows organizations to model dozens of scenarios instantly, helping them prepare for best, worst, and most-likely outcomes.

4. Expense Monitoring and Control

AI actively monitors expenses as they occur, categorizing and analyzing them in real time. It can highlight anomalies, identify overspending, and raise alerts before problems escalate. This allows immediate corrective action instead of waiting until month-end reports reveal the issue.

5. Adaptive Budgets

Static budgets are rigid and often irrelevant after a few months. AI-driven budgets are flexible and constantly evolving. They shift as conditions change, enabling organizations to maintain rolling forecasts rather than outdated annual plans.

6. Simplified Insights

Complex financial models often overwhelm non-financial leaders. AI simplifies communication by turning numbers into clear, actionable insights. Decision-makers can receive straightforward answers to key financial questions without needing to sift through pages of reports.

Benefits of Budgeting with AI

The advantages of AI in budgeting go far beyond convenience. They fundamentally improve the way organizations plan and operate:

-

Accuracy – With real-time data feeding predictive models, budgets become more reliable and less prone to costly errors.

-

Efficiency – Automated processes reduce manual work, freeing finance teams to focus on analysis and strategy.

-

Agility – Continuous forecasting helps organizations respond quickly to market changes, mitigating risks and seizing opportunities.

-

Cost Savings – AI identifies inefficiencies, wasteful spending, and cost leaks, helping organizations optimize resources.

-

Strategic Decision-Making – Leaders gain richer insights that enable smarter allocation of capital and resources.

The result is not just better budgets, but better business performance overall.

Overcoming Challenges

Despite its promise, AI budgeting is not without hurdles. Organizations must be aware of the following:

-

Data Quality – The accuracy of AI insights depends heavily on the quality of the underlying data. Incomplete or inconsistent data weakens outcomes.

-

Implementation Costs – AI requires investment in technology, integration, and training. While the long-term benefits outweigh the costs, upfront resources are necessary.

-

Change Management – Finance professionals need to adapt to a new way of working, shifting from manual control to trusting automated insights.

-

Cybersecurity – With sensitive financial data involved, security must be a top priority. Protecting systems from breaches is essential when integrating AI.

By addressing these areas strategically, organizations can unlock the full potential of AI budgeting while minimizing risks.

The Future of Budgeting with AI

The evolution of budgeting through AI is only beginning. In the future, we can expect even more advanced capabilities:

-

Hyper-Personalized Budgets – Financial plans will be uniquely tailored to each organization’s structure, performance, and goals.

-

Conversational Budgeting – Leaders will interact with their budgets through natural language queries, receiving clear and immediate responses.

-

Real-Time Integration – Budgets will continuously update based on live data from markets, suppliers, and internal systems.

-

Self-Optimizing Budgets – AI will automatically reallocate resources in response to performance changes, reducing the need for human intervention.

Budgeting will shift from being a static, backward-looking process to a continuous, intelligent system that actively guides decisions on a daily basis.

Smarter Budgets, Stronger Businesses

AI is not just enhancing budgeting—it is redefining it. The transformation from rigid spreadsheets to adaptive, intelligent financial systems represents a fundamental shift in how organizations plan, allocate, and control resources.

By adopting AI-driven budgeting, organizations can:

-

Remove inefficiencies and errors

-

Improve accuracy in forecasting

-

Stay agile in uncertain markets

-

Free finance teams to focus on strategy and leadership

The future of budgeting is intelligent, adaptive, and data-driven. Organizations that embrace this future today will position themselves not only to withstand uncertainty but to thrive in it.