Why You Should Care About AI in Finance

Let’s get real. Finance isn’t frozen in time—it’s evolving fast. Every day, businesses are under pressure to optimize costs, move quicker, and make smarter decisions based on data.

Meanwhile, the world of AI is blasting forward: tools that once seemed futuristic are now everyday helpers. The truth? AI isn’t just for big tech firms—it’s now super relevant to businesses of all sizes, especially those with financial operations.

If you run a bookkeeping firm, manage multiple locations, or advise clients on CFO‑level strategy, getting familiar with AI isn’t optional anymore.

It’s a competitive advantage. But the AI landscape is full of intimidating jargon. So instead of confusing “transformer models” or “deep reinforcement learning,” let’s keep it simple. Focus on real tools, real outcomes, and how they apply to your day‑to‑day finance world.

Here are the Top 10 AI concepts you need to know, explained in a friendly, story‑driven way. Each one includes:

- What it is, in plain terms

- Why it matters to your finance operations

- Real examples of how businesses use it

- Simple steps to begin implementing it

1. Machine Learning (ML) – Teaching Computers to Learn from Your Data

What it is, in normal language:

Think of machine learning as teaching a computer to recognize patterns, without you telling it every rule. Just like a kid learns from repeated experiences, the computer learns from your historical data: invoices, payments, trends.

Why it matters to your business:

Your business generates tons of data—sales records, seasonal swings, vendor pricing changes. Machine learning sifts through it and spots patterns you might overlook. Over time, it gets smarter, allowing for better forecasting and smarter decisions where humans alone can’t keep up.

Real-world example:

Imagine you run a seasonal retail chain. In summer, cash flows spike; in winter, they dip. Machine learning can analyze three years of data and start predicting exact cash flow per week, factoring in holidays, marketing campaigns, or even temperature changes. That gives you a way to plan staffing, inventory, or credit lines in advance.

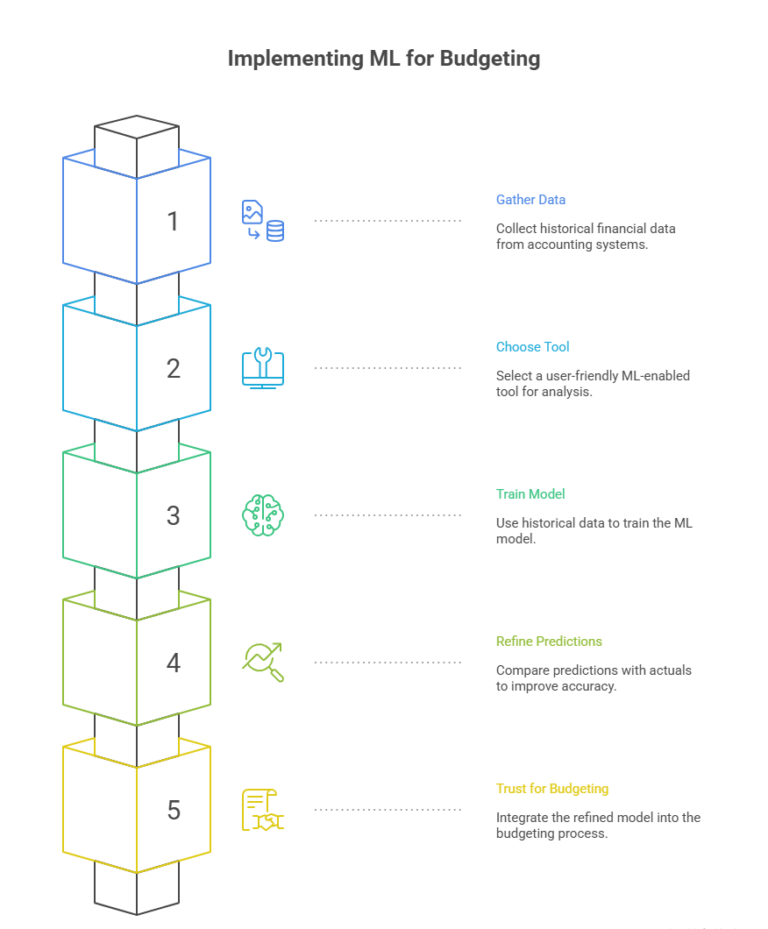

How to start:

- Gather historical data from your accounting or ERP system

- Pick a simple ML‑enabled tool (many cloud accounting systems offer it)

- Train it on past data and compare its predictions to your actuals

- Refine and start trusting it for budgeting

2. Natural Language Processing (NLP) – AI that Understands Human Language

What it is, simply:

NLP helps computers understand text or speech. It’s the tech behind chatbots and email bots—so your systems can read and interpret written language like invoices, emails, or notes.

Why it matters:

Finance teams deal with tons of communication—vendor memos, client emails, approvals. NLP allows AI to read and categorize this text automatically. It can, for example, flag an urgent client request, extract key details, or even draft replies on your behalf.

Real-world example:

A bookkeeping firm receives 100s of client emails per week. NLP scans those and filters out common repeat questions—“Where’s my invoice?”, “When is the next payment due?”—and instantly replies with predefined responses or escalates complex ones to a human.

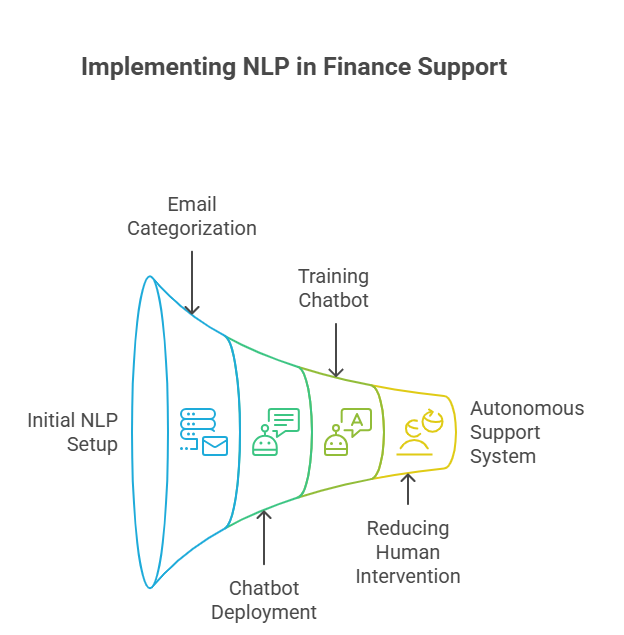

How to start:

- Use an email tool or plugin that scans and categorizes your messages

- Leverage chatbot software for your finance support page

- Train it with FAQs and common client questions

- Gradually back off human intervention as confidence builds

3. Predictive Analytics – Forecasting the Future Using Past Patterns

What it is:

Predictive analytics combines history and statistics to forecast what’s likely to happen next. It’s not perfect, but it beats guessing.

Why it matters:

Predicting issues before they happen gives you time to react—or steer clear entirely. You can preempt late payments, spot spending spikes, or plan cash needs in advance.

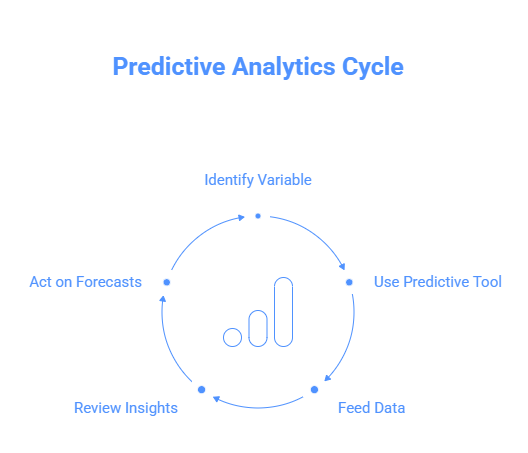

How to start:

- Identify the variable you want to predict (e.g. cash flow, customer payments)

- Use a tool that supports predictive features—many CRMs or financial platforms include them

- Feed your past 6–12 months of data

- Review insights and act on forecasted issues or opportunities

Real-world example:

A healthcare group uses predictive analytics to forecast payroll costs when patient visits rise. When they see a trend toward under‑insurance, the system warns them three weeks ahead so they can adjust staffing or payment terms.

4. Robotic Process Automation (RPA) – Automate the Boring Stuff

What it is:

RPA involves bots—software robots—that carry out structured, repetitive tasks by mimicking human keystrokes. No complex decision‑making—just rule‑based tasks done with speed and accuracy.

Why it matters:

It frees up your team. Month‑end closing, invoice matching, bank reconciliation—these are repetitive and error‑prone if done manually. RPA handles them consistently and quickly.

Real-world example:

In a CFO-led consulting business, bots log into the accounting system, pull bank statements, reconcile with recorded transactions, and generate trial balance reports—all automatically after hours. What used to take human hours now takes minutes.

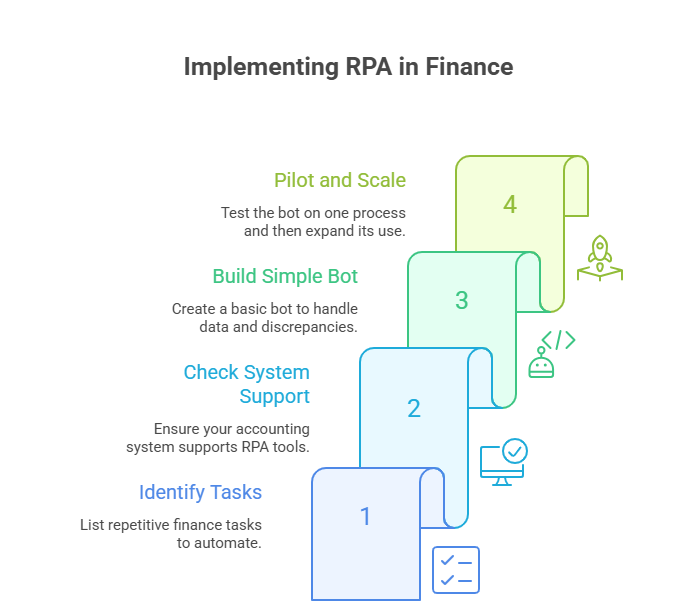

How to start:

- List your repetitive finance tasks (data entry, reconciliation, reporting)

- See if your accounting system supports plug‑in RPA tools

- Build a simple bot—e.g., download bank data, match it, flag discrepancies

- Pilot it on one process—then scale

5. Anomaly Detection – Catch the Weird Stuff Early

What it is:

This AI scans large datasets to find anything that “doesn’t belong”—a sudden spike, repeated invoice, or odd transaction. It’s like a radar that alerts you when something feels off.

Why it matters:

Manual reviews often miss subtle patterns. An automated anomaly detection system works 24/7 and can detect fraud, errors, or unusual spend faster—before the damage spreads.

Real-world example:

A small finance department started getting alerts when a vendor invoice showed up for twice the usual amount, or when payments were scheduled at odd hours. Early alerts let them pause the transactions and address it impulsively.

How to start:

- Ensure current finance software includes anomaly detection or integrate a third‑party tool

- Set thresholds (e.g. percent variance from normal)

- Start with minimal sensitivity and adjust as you trust the alerts

- Review flagged items daily

6. Optical Character Recognition (OCR) – Turn Paper into Usable Data

What it is:

OCR converts scans or photos into text. It extracts characters so that invoices, receipts, and documents become searchable and usable in digital workflows.

Why it matters:

Still managing piles of paper receipts and invoices? OCR turns them into digital entries quickly. You no longer need to type each line manually—saving hours and reducing typos.

Real-world example:

A multi-location healthcare business scans vendor invoices and patient receipts. OCR tools populate details automatically into their AP system. Auditors are happy, bookkeeping errors drop, and staff time is reclaimed.

How to start:

- Use an app or plugin that integrates OCR with your accounting software

- Scan batches of invoices or receipts

- Confirm extracted data and let the system learn your formats

- Set up autoposting or data review rules

7. AI-Powered Forecasting – Intelligence Beyond Excel

What it is:

More than just spreadsheet projections, AI‑powered forecasting actively learns and adapts, incorporating external trends (like market indices, fuel prices, or seasonality) to improve prediction accuracy.

Why it matters:

Static budgets don’t adapt to reality—if sales drop or costs spike, your business quickly runs off track. AI forecasting helps you adjust plans on the go.

Real-world example:

A retail chain used AI forecasting to adjust inventory and staffing based on real-time foot traffic and external trends (weather, local events). That helped them keep margins up during holiday peaks and winter lulls.

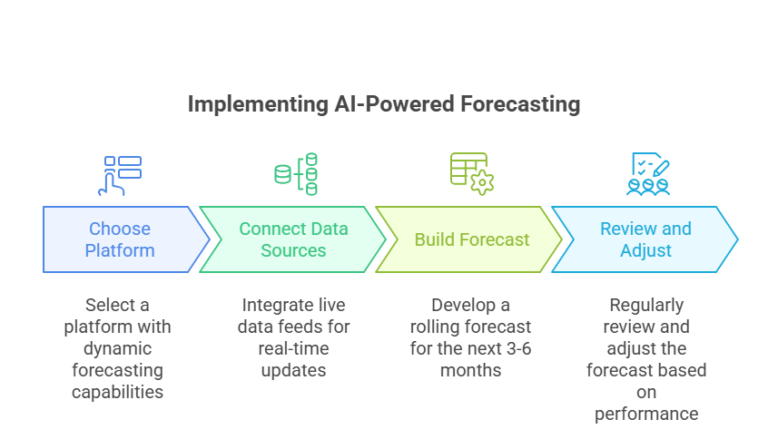

How to start:

- Pick an accounting or planning platform that includes dynamic forecasting

- Connect it with live data sources (e.g. sales, expenses, external market feeds)

- Use it to build a rolling 3‑ or 6‑month forecast

- Review monthly and course‑correct routinely

8. Chatbots and Virtual Assistants – Always‑Ready Financial Helpers

What it is:

Chatbots are AI tools that engage in virtual conversations—on your website, in apps, or over messaging platforms. Virtual assistants may also pull data, guide users through processes, or deliver reports.

Why it matters:

They give your clients real-time responses, 24/7, at almost no cost. You improve customer experience, reduce support bottlenecks, and free your staff for complex tasks.

Real-world example:

A bookkeeping firm set up a finance portal Q&A bot that helps clients check invoice status, download statements, or submit receipts. The bot solves 70% of common inquiries automatically, and more complex ones are escalated to humans.

How to start:

- Write down FAQs and common support scenarios

- Plug into a chatbot platform that integrates with your systems

- Start with simple flows (invoice status, payment due date)

- Monitor interaction quality and expand over time

9. Real-Time Analytics – Your Financial Dashboard on Speed

What it is:

Real-time analytics continuously tracks key financial metrics as data changes—cash availability, revenue, expenses, KPIs—updating dashboards instantly.

Why it matters:

Key decisions can’t wait for weekly or monthly reports. Real-time visibility helps you stay responsive and confident in your current financial standing.

Real-world example:

A CFO-led small business used real-time dashboards to monitor daily cash and expenses. When weekly expenses exceeded forecasts, the system alerted them. They paused discretionary spend until confirmed revenue came in.

How to start:

- Use finance software that provides live dashboards

- Choose crucial metrics you need daily visibility on (cash, payables, receivables)

- Set up alerts if thresholds are crossed

- Review dashboard daily or weekly as part of routine

10. Automated Compliance Monitoring – Staying Safe in a Changing World

What it is:

AI that tracks your transactions, documents, and reports against regulatory rules—identifying when something falls out of compliance or risk thresholds.

Why it matters:

Keeping up with tax rules, audit standards, and regulatory compliance is stressful and costly. A tool that flags potential issues ahead of time saves you from fines—or worse.

Real-world example:

A consulting outfit deals with clients across states. Their compliance tool scans invoices, timesheets, and billing to ensure state tax codes, thresholds, and expense policies are honored. Missing documents or exceeding limits trigger alerts before submission.

How to start:

- Identify your key compliance concerns (tax filing, expense policies, foreign currency, etc.)

- Choose a platform that aligns with your industry or geography

- Define rules or thresholds (e.g. max per‑diem, invoice amounts, filing dates)

- Let the tool monitor and start getting alerts

A Roadmap for Business Owners

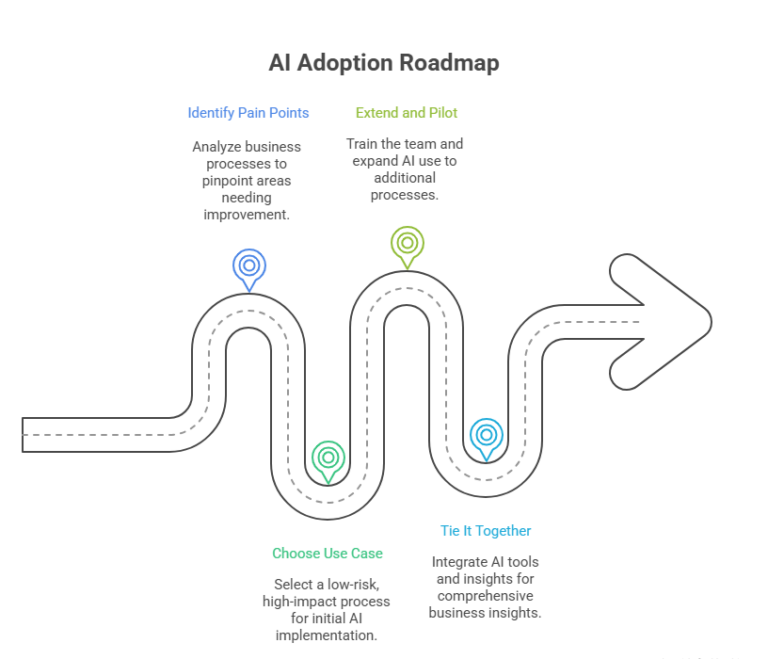

So you’ve got 10 powerful AI tools on the table. But how do you begin? Here’s a smart way to phase adoption:

Phase 1: Identify Pain Points

What takes up most time? (e.g. manual entry, invoice scanning, collections?)

Where are errors happening most frequently?

What insights do you wish you had more quickly?

Phase 2: Choose Your First Use Case

Pick one process that’s repetitive or error‑prone

Ideally low‑risk but high-impact (e.g. OCR onboarding, basic bot, cash‑flow forecasting)

Implement quickly to build confidence

Phase 3: Extend and Pilot

Train your team on the tool

Monitor results, tweak rules

Expand to a second use case (e.g. anomaly detection after OCR, ML forecasting after bot)

Phase 4: Tie It Together

Integrate tools: e.g. feed OCR‑extracted data into anomaly detection

Use insights from predictive analytics to feed into budgeting tools

Build dashboards that combine real‑time analytics with forecasted data

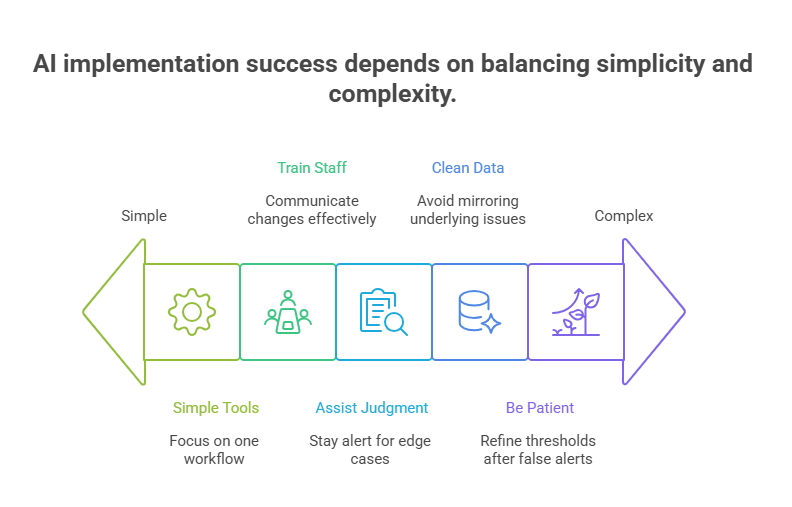

Mistakes to Avoid and Tips to Succeed

Don’t overcomplicate from the start:

Begin with simple tools and one focused workflow

Avoid building monster AI projects you can’t maintain

Be patient:

Allow AI to learn and adapt—especially anomaly detection and ML forecasting

Don’t abandon tools after a few false alerts; refine the thresholds

Involve the team:

Train staff, communicate changes

Make sure everyone understands what’s automated—and what they still oversee

Set realistic expectations:

These tools assist—not replace—human judgment

Stay alert for edge cases and exceptions

Keep data clean:

Garbage in, garbage out. If your underlying data or documentation is wrong, AI will mirror those issues.

Looking Ahead: What’s Next for Finance AI

The tools we’ve covered are driving real value now. But the future holds even more:

AI‑driven scenario planning: Imagine asking, “What if interest rates rise 3%?” and seeing forecast adjustments instantly.

Voice‑based assistants: Say “Show me this month’s variance” and hear the response—no clicking.

Deeper risk insights: AI combining finance, market, economic, and compliance data for real‑time risk dashboards.

Automated strategy generation: Tools that suggest cost‑cutting moves, pricing changes, or cash reserves adjustments automatically.

By staying informed about these emerging capabilities, you’ll be able to evaluate and adopt right away as they mature.

Wrapping Up: How to Lead with AI in Finance

You don’t need to become a data scientist to use AI effectively. The key is to understand how these tools can support your goals:

- Save time on admin tasks

- Improve financial accuracy

- Predict problems before they bite

- Stay compliant and reduce risk

- Make smarter, faster decisions

Start small. Target one process. Learn, refine, and expand. With even a few of these AI capabilities in place, you’ll be freeing your team from repetitive work—and empowering them to focus on strategy, growth, and delivering value.

Next Steps You Can Take Today

Audit your finance processes: Where do you spend most time?

Investigate low‑cost tools: E.g. OCR scanners, chatbot builders, RPA integrations with your existing software

Start a pilot: Pick one concept (e.g. anomaly detection or forecasting), trial it for 30–60 days

Review impact: Measure time saved, errors reduced, capacity freed

Plan expansion: Layer in other AI capabilities (ML forecasts, chatbots, compliance monitors)

Need help getting started?

If you’d like help implementing any of these tools—OCR, chatbots, ML forecasting, RPA, or compliance automation— S.K.I.L.L. Consultants offer tailored support for finance teams and businesses.

We help choose the right tech, set up the workflows, and train your team so you can focus on growing your business—without wrestling spreadsheets.

Feel free to reach out to get:

A complimentary AI readiness assessment

Help building a pilot program for OCR or forecasting

A mock finance process optimized with bots and automation.