For many business leaders, the words “financial model” evoke spreadsheets, balance sheets, and endless tabs of formulas. But that perception undersells what a financial model really is—and what it can do for your business.

A high-quality financial model is far more than a collection of numbers. It’s a strategic tool that turns data into direction, vision into action, and risk into manageable reality. Whether you’re leading a startup, scaling a mid-sized company, or preparing for a merger, a financial model is not just helpful—it’s critical.

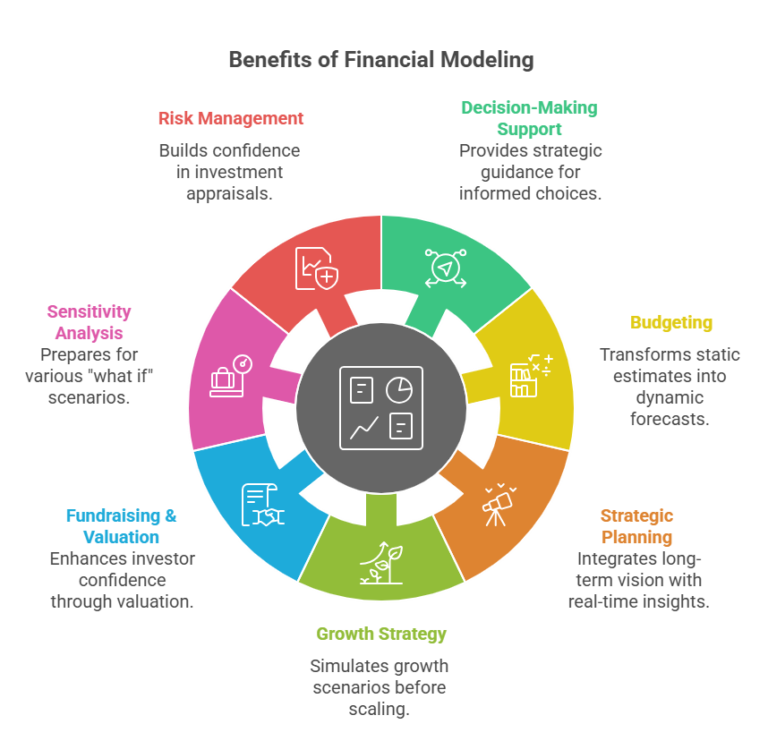

Let’s explore the seven essential functions of a robust financial model and why it could be the most valuable asset in your decision-making toolkit.

1. Decision-Making Support: Your Strategic Compass

Business decisions—especially the big ones—require more than instinct. A financial model transforms assumptions into structured forecasts, allowing you to test hypotheses before taking action.

Why this matters:

Making decisions without data is like sailing without a compass. Financial models enable you to evaluate different scenarios, estimate return on investment (ROI), and align your team around clear, evidence-based choices.

Example:

Planning to hire five new employees? A model helps you forecast salary costs, benefits, training expenses, and potential productivity gains—all mapped against projected revenue and cash flow.

2. Budgeting: From Static Estimates to Dynamic Forecasts

Budgeting can either be a guessing game—or a precise, flexible process. When grounded in a financial model, budgeting becomes forward-looking, data-driven, and adaptable.

Why this matters:

Rather than relying on past results or intuition, your budget reflects current business drivers, market conditions, and operational realities. This dynamic approach allows you to revise in real time as conditions change.

Quick benefit:

Test multiple budget scenarios—best-case, worst-case, and base case—to plan for uncertainty and allocate resources efficiently.

3. Strategic Planning: Long-Term Vision With Real-Time Insight

Growth doesn’t happen by chance. A financial model helps you project several years ahead, providing the foundation for long-term strategic planning.

Why this matters:

Your business roadmap should align with your financial reality. Whether you’re launching a new product, entering new markets, or acquiring a competitor, your model ensures your strategic goals are financially viable.

Did you know?

Mergers and acquisitions often depend on strong forward-looking models to evaluate synergies, integration costs, and potential combined returns.

4. Growth Strategy: Simulate Before You Scale

Growing a business takes resources, risk tolerance, and smart planning. Financial models allow you to test growth strategies before deploying capital.

Why this matters:

Models give you a virtual testing ground. Should you increase prices, expand to a new region, or scale up marketing spend? Run the numbers before committing—minimizing risk and maximizing return.

Bonus insight:

Align your marketing, sales, and operations teams around financial projections, so everyone is rowing in the same direction.

5. Fundraising & Valuation: Gaining Investor Confidence

When you pitch to investors or approach lenders, they’ll ask one thing early on: Where’s your financial model?

Why this matters:

A sound model demonstrates business acumen, strategic thinking, and operational clarity. It builds trust by showing how you plan to grow, how much funding you need, and what the potential return will be.

What investors look for:

Unit economics

Cash burn and runway

Break-even analysis

EBITDA projections

Exit scenarios

Expert tip:

Your model is key to determining and defending your valuation. It can also help negotiate favorable deal terms by showing expected returns over time.

6. Sensitivity Analysis: Be Ready for “What If” Scenarios

Markets fluctuate. Supply chains break. Customer behavior shifts. A strong financial model includes sensitivity analysis to assess how your business responds to change.

Why this matters:

You need to know what happens if revenue drops 10%, or if raw materials double in cost. Sensitivity testing equips you to develop contingency plans and stay agile.

Variables worth testing:

Pricing changes

Customer churn

Wage inflation

Logistics disruptions

Market downturns

Our approach:

We build models that don’t just show a single forecast, but a full range of scenarios—optimistic, conservative, and everything in between.

7. Risk Management & Investment Appraisal: Confidence Before Commitment

Major investments—whether in people, property, or technology—require more than gut instinct. Your financial model acts as a risk filter, helping you evaluate feasibility and long-term ROI.

Why this matters:

Models reduce blind spots. They clarify how long an investment will take to pay off, where hidden costs may lie, and what impact it will have on overall cash flow.

With our guidance:

You’ll make capital allocation decisions based on measurable data, not hope. That’s how smart businesses grow.

A well-built financial model is not just a forecasting tool. It’s your decision-support system, your investor brief, your budgeting platform, and your growth simulator—all rolled into one.

At S.K.I.L.L. Consultants, we don’t just build spreadsheets. We design tailored financial models that empower confident decisions—whether you’re raising capital, scaling operations, or entering new markets. Our mission is to remove the guesswork from growth so you can lead with clarity.