AI is showing up everywhere these days—from smart ovens to AI-powered toothbrushes. But when it comes to accounting, the stakes are a lot higher than clean teeth or perfectly toasted bread.

Now, every software in the finance world seems to be shouting “We have AI!” But let’s be honest—does every so-called AI feature really help accountants get their job done faster or smarter? Not always.

So, to help you separate the game-changing tools from the gimmicks, here’s a list of AI solutions that actually help accountants do more with less—without the fluff.

First Things First: Your Data Matters

Let’s be real—AI is only as smart as the data you feed it. If your accounting data is messy, outdated, or scattered, no AI tool is going to magically fix it.

Before using any AI tool, make sure your data is:

Before using any AI tool, make sure your data is:

Clean and consistent

Properly categorized

Backed by complete documentation

Think of it like cooking—AI is the fancy kitchen tool, but if you start with bad ingredients, the result will still taste bad.

1. ChatGPT: The Accountant’s AI Sidekick

What it does:

ChatGPT is like having a super-knowledgeable assistant who can read, write, explain, and research—instantly. You can ask it almost anything, and it’ll respond in plain language.

Why accountants love it:

Writes accounting memos, emails, and reports in seconds

Explains tricky topics (like lease accounting or revenue recognition)

Helps clean up messy Excel formulas

Summarizes long regulatory updates or client documents

Try this: Ask it to break down the difference between GAAP and IFRS in one paragraph.

Try this: Ask it to break down the difference between GAAP and IFRS in one paragraph.

2. Claude: For Smart, Human-Like Writing

What it does:

Claude (by Anthropic) is another AI chatbot—but it’s especially good at writing in a warm, natural tone. It’s like ChatGPT with extra people skills.

Best for:

Writing sensitive client emails

Explaining financial data to non-finance folks

Drafting presentations or internal reports with more polish

When to use it: Any time your writing needs to sound thoughtful and approachable—not robotic.

3. BILL: AI That Takes Over Invoice Processing

What it does:

BILL uses AI to manage your accounts payable and receivable. It reads invoices, pulls out key details, and kicks off approval workflows automatically.

How it saves time:

Scans and enters invoice data with little human input

Flags errors or duplicates

Routes invoices to the right people for approval

Best for: Accounting teams swamped with supplier invoices, especially across multiple entities or countries.

Let’s Get Connected To

The Future of Business Automation

As technology continues to advance, business automation will become even more sophisticated. Artificial intelligence (AI) and machine learning (ML) are set to revolutionize automation, allowing systems to learn and adapt over time. In the near future, more businesses will use AI-driven tools for predictive analytics, customer service, and even strategic decision-making.

Glean.ai: Know Where Every Rupee (or Dollar) Goes

What it does:

Glean.ai doesn’t just automate payments—it gives smart insights into your spending. Think of it as your AI-powered financial detective.

What it helps with:

Analyzing vendor spend trends

Spotting unusual charges

Benchmarking your expenses against industry norms

Bonus: Works great with QuickBooks, NetSuite, and other ERPs.

Bonus: Works great with QuickBooks, NetSuite, and other ERPs.

Klarity.ai: AI That Reads Contracts for You

What it does:

Klarity scans through contracts, financial agreements, and statements to pick out critical info—like payment terms, renewal clauses, and potential risks.

Why it’s helpful:

Flags issues that may affect revenue recognition or compliance

Pulls key info like amounts, dates, or obligations

Supports audit prep by organizing documentation

Best use case: Fast-growing businesses with lots of new contracts coming in.

Best use case: Fast-growing businesses with lots of new contracts coming in.

Trullion: AI for Lease & Revenue Accounting

What it does:

Lease accounting is a detail-heavy nightmare for many teams. Trullion turns it into a smooth process by using AI to extract and convert lease terms into journal entries.

Key benefits:

Compliant with ASC 842 & IFRS 16

Converts PDFs into accounting-ready data

Creates audit-friendly reports automatically

Why this matters: It saves hours on spreadsheets and reduces risk of misreporting.

Why this matters: It saves hours on spreadsheets and reduces risk of misreporting.

Need Help? Contact S.K.I.L.L Consultants Today!

Ramp: Smarter Spending with AI Insights

What it does:

Ramp helps manage expenses by issuing cards, tracking spending, and using AI to find savings.

What you get:

Auto-categorized transactions

Duplicate spend alerts

Smart suggestions to cut costs (like canceling unused software)

Why it’s cool: It learns your company’s habits and gets better at managing approvals over time.

Why it’s cool: It learns your company’s habits and gets better at managing approvals over time.

Brex: Corporate Card + AI-Driven Controls

What it does:

Brex started as a card provider, but now it’s a full financial ops system. Its AI flags risks before you even notice them.

Why it’s helpful:

Suggests GL codes automatically

Applies your expense policy without manual checks

Syncs easily with ERPs

Real-world win: Reduces compliance headaches by catching out-of-policy spend early.

Real-world win: Reduces compliance headaches by catching out-of-policy spend early.

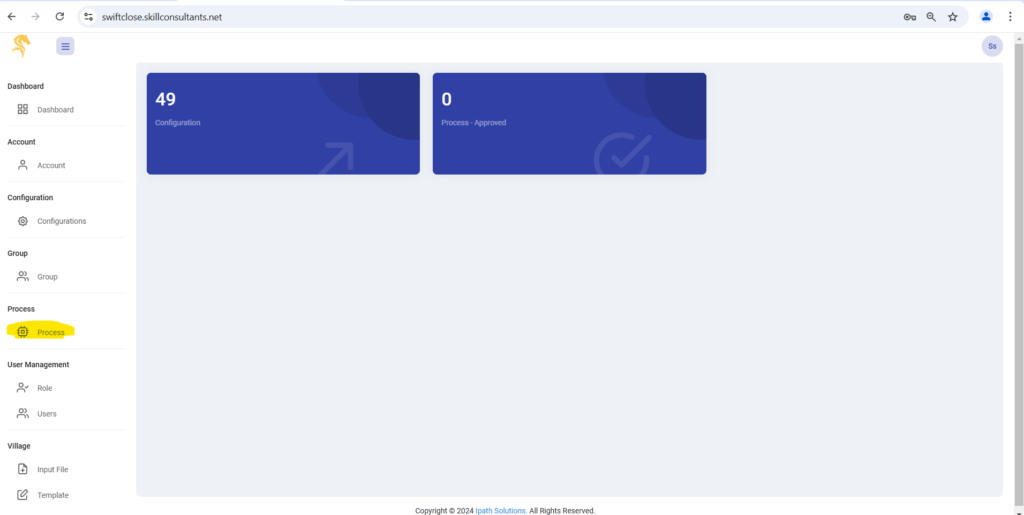

Swift Close: AI That Speeds Up Month-End Closing

What it does:

Swift Close automates the most painful part of accounting—month-end close. It handles reconciliations, journal entries, and even final reports using AI.

Biggest advantages:

Cuts close time by 30–50%

Reduces manual reconciliations

Creates a cleaner audit trail

Strategic edge: Your team spends less time crunching numbers, and more time making sense of them.

Strategic edge: Your team spends less time crunching numbers, and more time making sense of them.

Smart Tools Still Need Smart Teams

Here’s the bottom line: AI is powerful, but it’s not a magic fix.

Before jumping into any tool, ask yourself:

What specific problem are we trying to solve?

Do we have the data and process to support this tool?

Who will train the team and monitor the results?

AI won’t replace accountants—it makes them faster, sharper, and more strategic. But only if you use it with purpose.

Ignore the Noise, Focus on the Impact

AI is the future of accounting—but only if used wisely. The real winners will be teams who:

Use tools that actually save time

Keep their data clean and organized

Build smart workflows around these tools

So the next time you see an “AI-powered” badge, pause and ask: Is this solving a real pain point—or is it just hype?

Start small. Choose one or two tools from this list. Test them. Measure the impact. Then scale what works.

Because the goal isn’t to follow the AI trend—it’s to transform your accounting process from routine to remarkable.