Running a business in the United States today is no easy task. Between navigating IRS compliance, managing payroll, staying on top of vendor payments, and making sense of ever-changing financial regulations—it’s easy to get lost in the numbers.

But here’s the truth: smart business decisions start with clean books.

At S.K.I.L.L. Consultants, we’ve seen it time and time again—when business owners have access to accurate financial data, they make better, faster, and more profitable choices. Whether you’re a solopreneur, a growing e-commerce brand, or a multi-location service provider, professional bookkeeping is the secret weapon that keeps your business healthy, agile, and audit-ready.

Let’s break down why accurate bookkeeping in the U.S. isn’t just important—it’s essential.

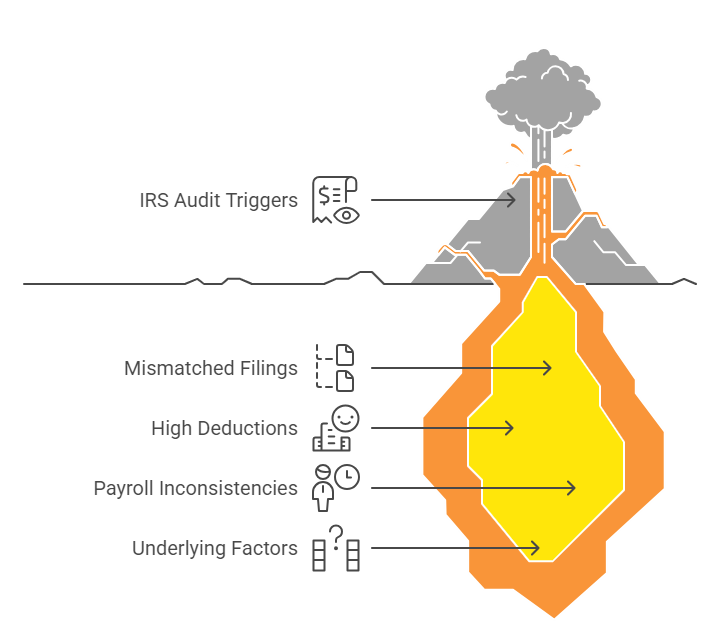

1. It Keeps You IRS-Ready—Always

In the U.S., the IRS can audit your business up to three years back (and six years in some cases). That means your books need to be airtight—not just during tax season, but year-round.

Common IRS triggers for audits:

Mismatched 1099/1096 filings

High deductions relative to income

Payroll inconsistencies

If you’re not recording income and expenses properly, you risk penalties, back taxes, and unnecessary stress.

Our role: We track every transaction, categorize expenses as per IRS Schedule C or Form 1120, and reconcile your books monthly—so your tax filings are 100% accurate and audit-proof.

2. It Improves Your Cash Flow Decisions

A U.S. Bank study revealed that 82% of small businesses fail due to cash flow mismanagement—not a lack of profits. That’s right: your business can be profitable on paper and still run out of cash.

Example:

You run a construction business. You invoiced $150,000 this month—but clients pay in 30-60 days. Meanwhile, you’ve got payroll, materials, and rent due now. Without good books, this timing gap catches you off guard.

Our role: We provide detailed cash flow forecasts that show you how much working capital you actually have—and when. That means no more surprises and no more bounced payments.

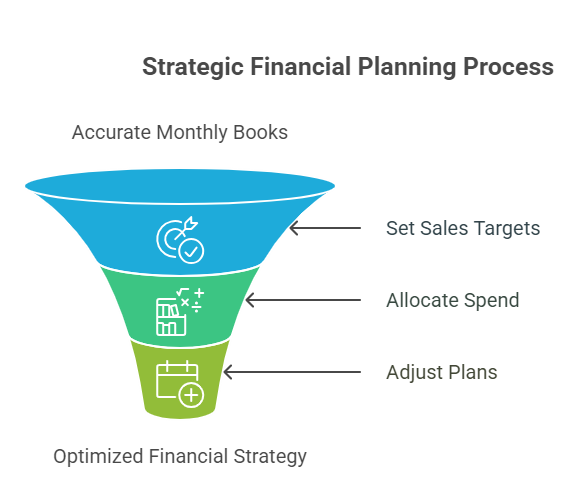

3. It Helps You Budget with Real Numbers

Most U.S. businesses set budgets based on guesswork or last year’s tax return. But that’s like driving forward while looking in the rearview mirror.

With accurate monthly books, you can:

Set realistic sales targets

Allocate spend by department

Adjust plans based on seasonality or inflation

Fun Fact: The Bureau of Labor Statistics says U.S. small businesses with structured budgets are 50% more likely to survive past year 5.

Our role: We create custom monthly reports and dashboards, so you can see trends in sales, expenses, and profitability across time—helping you budget smarter and grow faster.

4. It Flags Financial Red Flags Early

Bad bookkeeping leads to blind spots. Good bookkeeping works like a financial radar—it spots issues before they become problems.

Examples of red flags we catch:

Double charges from vendors

Forgotten subscription renewals

Payroll mismatches with Form 941

Underreported income (triggering audit risk)

Our role: With monthly reconciliation, error tracking, and real-time dashboards, we flag anomalies early and help you take corrective action—before it affects your bottom line.

5. It Builds Trust with Lenders, CPAs, and Investors

Planning to apply for an SBA loan, bring on a partner, or raise VC funding? Every financial conversation starts with a simple ask: “Can you share your last 12–24 months of financials?”

If your books aren’t in order, your opportunities can disappear quickly.

Lender stat: SBA lenders reject 60% of loan applicants due to incomplete or disorganized financials.

Our role: We maintain tax-ready, GAAP-compliant books, formatted for banks and CPA reviews. We’ll even coordinate with your CPA during tax season or loan applications to ensure everything checks out.

6. It Supports Smooth Payroll and 1099 Filing

In the U.S., payroll taxes and contractor compliance can trip up even the most organized business owners.

Missed deadlines for Form 941 or 940?

1099s not matching IRS records?

W-2 errors creating confusion for employees?

These small issues can lead to big penalties—and damaged trust with your team.

Our role: We sync your books with payroll tools (like Gusto or ADP), track contractor payments, and prepare compliant 1099/1096 filings on time—no scrambling in January.

7. It Enables Easy Integrations and Automation

Modern U.S. businesses run on tools—Shopify, Stripe, QuickBooks, Swift Close, and more. But these tools don’t talk to each other unless the underlying data (your books) is accurate.

Stat: Companies that integrate bookkeeping with other platforms save an average of 30 hours/month in admin work.

Our role: We don’t just keep books—we help you build a connected back-office. From POS to CRM to payroll to invoicing, we automate your finance stack to save time and reduce errors.

When your books are up to date, accurate, and aligned with your goals, you’re in control. You’re no longer reacting to financial surprises—you’re anticipating them.

At S.K.I.L.L. Consultants, we go beyond bookkeeping—we’re right there with you, helping steer your business toward smarter financial decisions. Our U.S.-based experts understand local tax codes, industry nuances, and compliance requirements—and we make sure your numbers aren’t just clean, but meaningful.